2022 was a bit of a rough year for Ford Motor Company (F) investors. Plagued by economic uncertainty, rising interest rates, chip shortages causing supply chain issues, and a stock price that's shed nearly half its value over the past year, investors were glad to close the book on 2022.

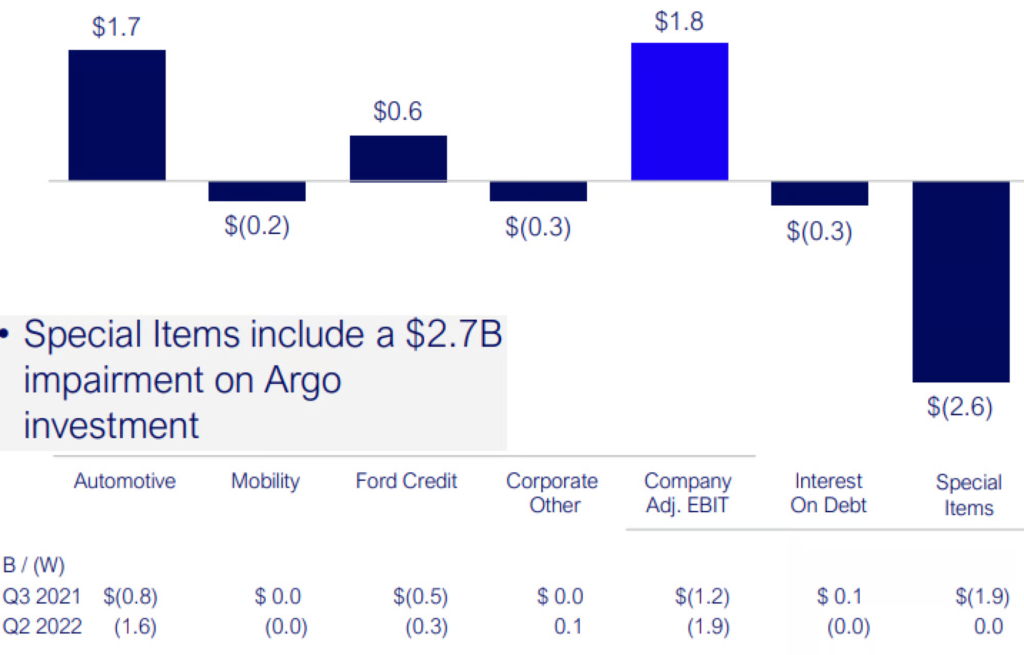

In addition to those negatives, Ford also turned in a third-quarter result that was significantly hindered by its $2.7 billion pre-tax impairment from its autonomous investment, Argo AI. For investors, Ford's $2.7 billion speed bump might actually be good news – here's why.

A match made in Heaven

The automotive industry is investing billions of dollars into autonomous driving technology and electric vehicles. Those two aspects of the auto industry appear to be a match made in Heaven as many companies envision fleets of self-driving electric vehicles.

While those two technologies seem to be a perfect match for the future, the reality is that fleets of electric vehicles will be ready for consumers long before they are driving themselves.

Because self-driving vehicles are likely in the distant future, it leaves auto investors in a tricky spot. Do investors prioritize long-term visions or short-term profits?

Fortunately, for Ford investors, the answer may be both. That answer is partially thanks to Ford's $2.7 billion impairment on Argo AI, and it will be a swift change in strategy.

Why the change of direction?

“We're optimistic about a future for L4 ADAS, but profitable, fully autonomous vehicles at scale are a long way off and we won't necessarily have to create that technology ourselves,” said President and CEO Jim Farley in a press release.

Farley is accurate on a couple of fronts here. Fully autonomous vehicles are far from contributing to Ford's bottom line, and that type of business is better suited for a start-up company that doesn't have to design, manufacture, and sell millions of vehicles globally each year.

The good news is that Ford pulling the plug on its Argo AI investment doesn't permanently exclude the company from the business of driverless vehicles down the road; it just focuses the company on what can boost its business in the near term.

With the uncertainty facing the automotive industry and economic environment, Ford's prioritizing its capital deployment should sit well with many investors, and it can avoid similar impairment charges in the meantime. For context, let's show just how big of a hit Ford's $2.7 billion impairment was to results.

What a viable pivot could look like

While Argo AI was a swing and a miss, Ford can now put future chunks of capital into developing L2+ and L3 advanced driver assistance systems (ADAS) to help improve vehicle technology options and, eventually, margins.

Ford can also better focus on delivering quality electric vehicles, a strategy that gained significant momentum in 2022. Ford's EV sales jumped 126% in 2022, compared to the prior year, and gained momentum in December, with sales spiking 223%.

Ford's massively important F-150 Lightning was America's best-selling truck in November and December while also hauling Ford to the second best-selling EV brand in the U.S. last year.

Management'a pivot from autonomous vehicle development to EVs could prove a great decision as the EV market seems to be less loyal in the full-size truck segments compared to traditional combustion engine trucks.

In fact, the F-150 Lightning's conquest rate — which is what the industry considers a sale to buyers who aren't currently customers — was marked at 75% earlier in 2022. That's an extraordinarily high mark in the automotive industry and suggests Ford's decision to focus on EVs could also lure in brand-new consumers, something its driverless vehicle program wouldn't be doing for quite some time.

Big decisions and big profits

Not even a decade ago, Wall Street analysts believed Ford's F-Series trucks generated almost 90% of the company's global profits. As EVs prepare to take over the roads, maybe Ford's $2.7 billion speed bump with Argo AI will prove to be fortunate as management can focus on critical EV launches such as its F-150 Lightning.

At the very least, amid economic uncertainty and a slowing auto industry, keeping the focus on strategies to improve short-term profitability — while still leaving the door open for long-term visions of driverless vehicles — could be a win for investors.

Conclusion: Should you invest in Ford right now?

For all the reasons above, Ford could be a good long-term investment. But before you make your next move, you'll want to hear this.

After nearly a decade of research and development…

Apple is preparing to unveil a brand-new device unlike anything it's ever attempted before… code name: Project Titan.

It could be 10X bigger than the iPad, the MacBook and the iPhone combined…

And my research shows that one tiny $5 tech company is perfectly positioned to help Apple make it all possible.

The numbers I've crunched indicate that this tiny, little-known stock could soar 40X once Apple's new device goes live.

Originally published on Fool.com

Daniel Miller has positions in Ford Motor Company. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.