Welcome to the week after the worst week for the Nasdaq (COMP) and S&P 500 (SPX) since March 2020.

While Federal Reserve tightening at the doorstep, a thus-far not great earnings season, continued COVID-19 fallout and even some geopolitical worries have been battering sentiment, here is Jefferies global equity strategist Sean Darby with another view:

“Our sense is that equity markets are experiencing the proverbial ‘shakeout’ that

perhaps should have unfolded in 4Q2021. We were one quarter too early,” said Darby, adding that the team has been “surprised to see how little discounting has taken place in view of faster tightening cycle,” said Darby, in a note to clients.

That said, he doesn’t see much mainstream panic out there, noting investors poured $8.73 billion into emerging-market themed equities and developed Europe last week.

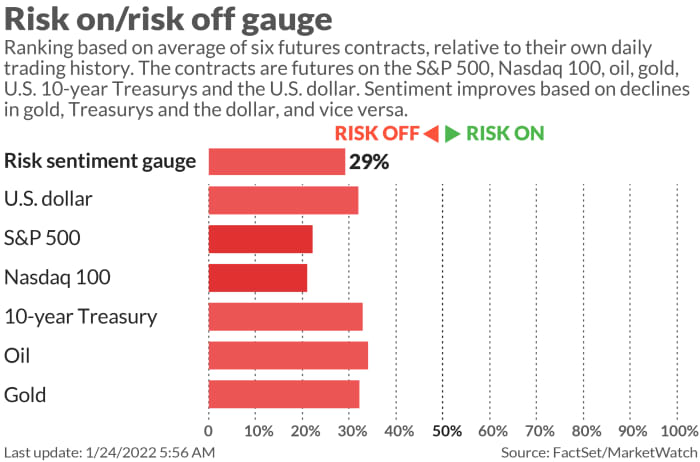

“The bottom line is that risk assets were already underperforming in 2021 (biotech, SPACs) and that the current de-risking has admonished both the more speculative areas and popular, high PE shares mostly in the U.S. credit spreads are widening in the U.S. but have to adjust from record negative real levels,” said Darby.

So OK, investors are dipping into Europe and EM, but when are the dip buyers going to make a dent in the Wall Street selling? Our call of the day, from RBC head of U.S. equity strategy Lori Calvasina and strategist Sara Mahaffy, sees a contrarian buy signal on the horizon.

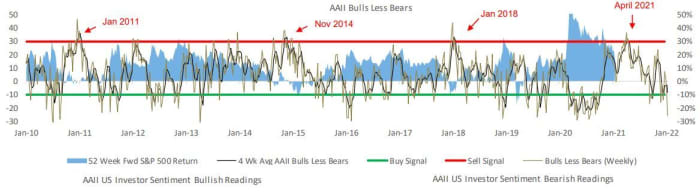

“There was one piece of very good news for stocks in our weekly indicators last week. Net bullishness on the AAII survey fell to -25.7% last week, close to pandemic lows (-29%),” said the pair. That mostly had to do with bulls being in retreat, while bears have “moved up but are not at past peaks yet,” said Calvasina and Mahaffy.

“On a four-week average, this indicator is at -8%, close to our -10% contrarian buy threshold (below the -10% threshold, the S&P 500 has been up 15% on average over the next 12 months 86% of the time). Note that in 2020, retail investor sentiment remained below the -10% four week average threshold for 12 weeks — but first got there in mid March,” they said.

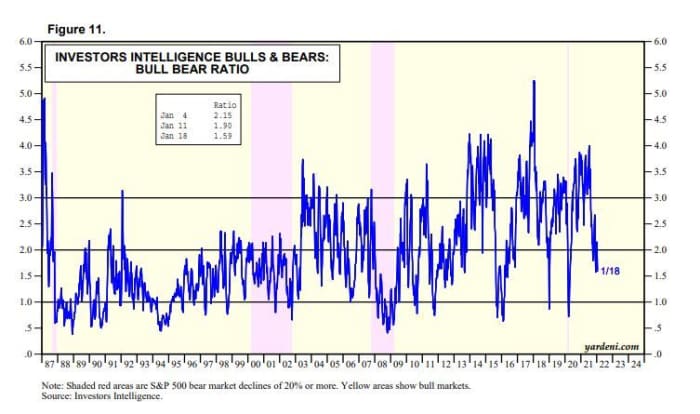

That same indicator was also cited by Yardeni Research’s Dr. Ed. Yardeni, who noted the weekly bull/bear ratio [BBR] dropped to 1.59 during the Jan. 18 week from 4.00 at last year’s peak during the July 13 week.

“The way the market traded this past week, the BBR likely fell closer to 1.00, which in the past has been a remarkably good buying indicator. The market does seem poised for a significant rebound, perhaps after the end of the latest FOMC meeting and Fed Chair Jerome Powell’s press conference on Wednesday,” said Yardeni.

Still, Yardeni said the current panic attack that he thinks began Jan 5., when the Fed released minutes of the Dec. 14-15 Federal Open Market Committee meeting, could “linger for a while.”

“During those previous three taper tantrums in the financial markets, the Fed had room to back off because inflation was so low, and it did so to calm the markets. That’s not likely to happen today because inflation is a serious problem,” he said.

The Markets

DJIA, SPX, COMP are deep in the red after last week’s selling. European stocks SXXP are getting hammered and Asia markets were mostly lower. The yield on the 10-year U.S. Treasury TMUBMUSD10Y is down 4 basis points to 1.71%.

Full story on MarketWatch.com