Once upon a time, Tesla (TSLA) was the “golden goose” in the electric vehicle industry.

But that time has come and gone.

Now it's time to look for EV stocks that are primed to steal Tesla's crown in the EV Race.

In the past five days Tesla stock dropped more than 17% to fresh 24-month lows. The stock is now down almost 70% in 2022. Shareholders are looking for someone to blame, and CEO Elon Musk is in their crosshairs.

But that's not why Tesla stock has crashed.

Sure, Elon's antics over at Twitter aren't helping things. But Tesla stock was crashing well before Elon ever took over the social media company.

What sparked Tesla's demise is something much more fundamental:

Market share erosion.

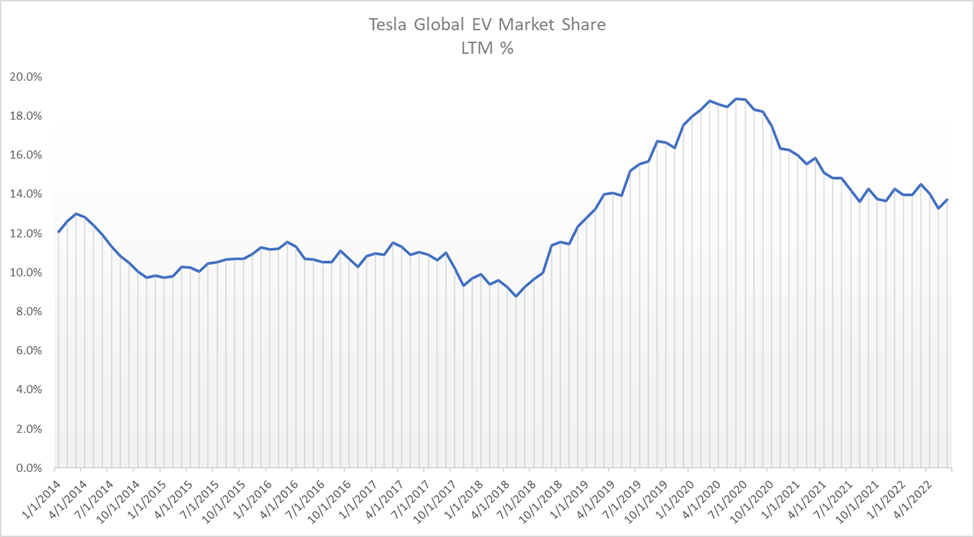

In the early 2010s, Tesla burst onto the scene as the first major pure EV maker. By the middle of the decade, the company commanded about 10% of the global EV market. Then, it had its big break in 2019 and 2020, when Tesla managed to successfully ramp production of its affordable Model 3 EV. During those two years, Tesla nearly doubled its global EV market share to over 18%.

But Tesla hasn't had a major “hit” or new launch since then. And at the same time, new EV competition has entered the fold.

The result? Tesla’s market share has rapidly eroded in 2021 and ‘22. As of June 2022 – the latest data available, per BloombergNEF – Tesla’s global EV market share stood at just 13.7%, down almost five full percentage points from its peak.

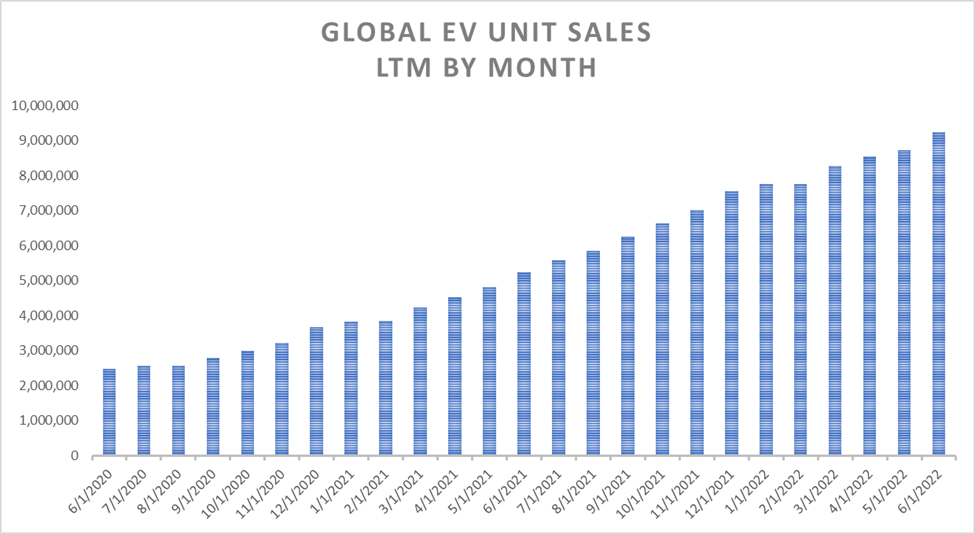

That’s bad news for Tesla. But it’s good news for someone else. If Tesla is losing market share, that means someone else is gaining it. And they’re gaining market share in a rapidly growing pie.

Just look at how much the EV market has grown since Tesla’s market share peaked in mid-2020. Global unit sales have risen nearly 300% since then, from 2.4 million cars in June 2020 to 9.3 million cars in June 2022.

Said differently, Tesla’s struggles are someone else’s great fortune.

So, who is winning this space right now? We have three EV stocks to buy right now to dethrone Tesla as the king of the industry.

Interestingly, each of these EV stocks is like Tesla. But each is better at a certain wide-appeal characteristic that could allow it to beat the titan.

Top EV Stocks: LCID

The first EV stock we like as a potential “Tesla killer” is Lucid (LCID).

For all intents and purposes, Lucid is Tesla – just better.

Tesla built its seemingly untouchable empire on top of three critical competitive advantages: talent, technology, and brand. Now Lucid is beating Tesla at all three.

First, Tesla has actually lost a bunch of talent over the past few years – and most of it (the very talent that built the company) is now at Lucid.

Of course, it all starts with Lucid’s CEO, Peter Rawlinson, the former chief engineer of the Tesla Model S. Yes. This is the guy who was the engineering brain behind Tesla’s flagship car – the one that started it all.

Supporting him is an impressive team of former Tesla, Audi, Apple (AAPL), Samsung (SSNLF), Ford (F), Intel (INTC), and GM (GM) execs. We’re talking folks who helped start Tesla and turn it into what it is today, as well as some very influential people behind some of Apple’s hero products, like the iPhone.

This is the most impressive confluence of talent in the EV industry outside of Tesla. And it’s not even close. Lucid Motors’ management team stacks up equally to the titan. And considering the current trend of Tesla losing talent and Lucid Motors gaining it, the latter will have much more talent than Tesla by 2025.

And indeed, with this remarkable engineering and design team behind it, Lucid has developed, tested, and fine-tuned some of the industry’s most impressive technology.

To answer your question, yes, this technology beats Tesla’s EV tech on every key performance indicator.

We’re talking longer driving ranges, more horsepower, denser motors, faster acceleration, tighter control – the works.

Up until last year, those specs were all talk, no walk. But now these super-high-performance Lucid cars are out in the real world, and they’re living up to the hype. In fact, the Lucid Air was named the 2022 MotorTrend Car of the Year.

Sure, these cars also cost an arm and a leg. They start at around $90,000. But that brings us to the last point: branding.

By making and selling $40,000 Model 3s (which look a lot like Model Ss) to college kids, Tesla has eroded its brand equity. Meanwhile, Lucid is coming to market with a premium brand equity that’s strengthened by its exclusivity.

It can get away with selling $90,000-plus cars because it has the brand and tech to match that price point.

Overall, then, we view Lucid as Tesla – just better. And that’s why LCID stock is one of our top EV stocks to buy at the current moment.

RIVN: TSLA, but Bigger

Next up, we have Rivian (RIVN). It’s another company that we feel is like Tesla, but it’s making bigger cars.

Rivian is an EV startup that is designing, manufacturing, and selling high-end electric SUVs and pick-up trucks. The SUV is a 7-seater with lots of space. The truck is a spacious truck with lots of power. They are fundamentally unique EVs in the marketplace today.

For five very specific reasons, we think Rivian could one day be one of the biggest EV makers in the world.

First, this is a leader in a strong demand niche of the burgeoning EV industry. We know that the trucking niche of the automotive market is very large with very durable and strong demand drivers. Presumably, as that portion of the auto market gets electrified, there will emerge an equally large electric truck market. Presently, there is no clear leader in that market. But Rivian has a promising early start with a fantastic first-to-market truck that has among the best specs in the industry. This electric trucking market will support multiple winners, and we’re confident Rivian will be one of them.

Second, the company has great brand equity, with strong technology and a fantastic first product. Rivian has established exceptional luxury branding and has developed leading EV battery and torque technology. These are two things that are very important for creating a great electric truck. Indeed, the R1T is probably the highest-performing electric pick-up truck in market today. And it should remain so for the foreseeable future.

Third, Rivian has strong early demand signals. Rivian has over 114,000 net preorders in the U.S. and Canada for the R1S and R1T, illustrating that consumers want these cars.

Fourth, Rivian has big support and partnerships. Rivian also has a very unique and promising partnership with Amazon wherein the latter will buy at least 100,000 electric delivery vehicles from Rivian. The extent of this partnership broadly implies that Amazon has basically picked Rivian as its “horse” in the EV race and, at scale, will convert its entire delivery fleet into Rivian cars. That represents a huge long-term opportunity.

Fifth, Rivian has a mammoth-sized balance sheet. The best thing about Rivian is that it has about $14 billion in cash on the balance sheet. And that grants the company an almost unfair advantage over peers. Rivian plans to use basically every penny of that cash balance over the next two to three years to develop market-leading tech, secure market-leading supply deals, and establish market-leading production capacity. When all is said and done, Rivian’s $14 billion should enable it to create an electric vehicle empire by 2025.

Overall, then, Rivian has the necessary ingredients to dominate Tesla in the eSUV and electric pick-up truck market. We really like RIVN stock for its long-term potential.

TSLA-Beating EV Stocks: FSR

Finally, we have Fisker (FSR) – a company we view as a cheaper version of Tesla.

Fisker is an EV startup that’s leveraging a platform-sharing business model. The company outsources all build components (except for design and software) to bring a high-performance electric vehicle to market at industry-low prices.

We love that strategy. We live in a world of hot inflation, high gas prices, and high interest rates. Indeed, in that world, expensive electric vehicles don’t sell as well as cheap ones do. And Fisker appears to be making the best cheap EV in the market.

That EV is Fisker’s Ocean SUV, which launched in November. It starts at $37,500, which is an absolutely unheard-of price for an eSUV model. It also features 250 to 350 miles of driving range, with a unique design, a new brand, and a great software package.

Economically speaking, the Ocean SUV gives consumers the most bang for their buck in the EV market. Unsurprisingly, reservations for this car already sit at an impressive 62,000 orders, and that number is growing quickly. That’s impressive momentum and easily puts Fisker on track to hit its ~42,000-unit delivery target for 2023.

We fully expect the Fisker Ocean SUV to be one of the best-selling electric cars in 2023.

More importantly, though, Fisker is about much more than just the Ocean SUV.

The Ocean SUV projects to be such a “big hit” because of its ability to optimally blend quality with affordability. This is a byproduct of competitive advantages Fisker has created through its platform-sharing model.

To that end, we don’t see Fisker as a one-hit-wonder with the Ocean SUV. We believe the company’s platform-sharing business model enables it to repeatedly launch popular EVs at the intersection of quality and affordability.

Management is targeting ~225,000 deliveries of four different EV models by 2025, with an average sales price of over $50,000. We think that’s entirely doable. If so, Fisker will net revenues of about $11 billion by 2025. We believe Fisker can achieve similar operating margins as Tesla, about 20%, which would put net profits at just shy of $2 billion (assuming a 20% tax rate).

A 20X multiple on that implies a potential future valuation here of $40 billion. The company is worth just $2.2 billion today.

That’s tremendous upside. And the risks are offset by an $824 million cash pile on the balance sheet that should more than absorb all cash burn next year (projected at $750 million) and bridge the gap to profitability in late 2023.

It’s clear to see why FSR stock is one of our favorite EV stocks to buy right now.

The Final Word on the Best EV Stocks

Tesla’s first-mover advantage in the big electric vehicle space is over.

Once upon a time, the only “cool” high-performance EV you could buy was one of its cars. That’s no longer true today. You have the Lucid Air, the Rivian R1T and R1S, and the Fisker Ocean, just to name a few.

That’s why Tesla’s global EV market share has eroded five points over the past two years. And that’s before Lucid, Rivian, and Fisker – its three biggest competitors – have hit mass production.

Once they do so between 2023 and 2025, Tesla’s global EV market share will dwindle below 10%… And other EV stocks will have the opportunity to soar as they gobble up Tesla’s market share.

Lucid, Rivian, and Fisker are three such EV stocks.

But there will be others – smaller, lesser-known EV stocks that score even bigger returns than Lucid, Rivian, and Fisker.

Originally published on InvestorPlace.com

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.