Last year was a much-needed reminder that just as there will be plenty of winning years in the stock market, there will also be a year of losses (or sometimes even two or three) sandwiched in between.

But that's what makes high-quality dividend growth stocks so appealing. No matter which way the market goes, the payouts of companies with decades of dividend growth behind them tend to go in one direction: up.

Abbott Laboratories‘ (ABT) 50-year dividend growth streak makes it one of just 43 Dividend Kings. But should income-oriented investors buy the healthcare stock now? Let's assess its fundamentals and valuation to see.

A difficult quarter, a promising outlook

With 113,000 employees and a presence in more than 160 countries, Abbott is among the largest healthcare companies in the world. Its diversified product line includes FreeStyle Libre continuous glucose monitors, Glucerna shakes and bars for blood sugar management, BinaxNOW rapid COVID tests, and dozens of generic medicines.

Sales dipped 12% year over year to $10.1 billion in its fourth quarter, ended Dec. 31, due to declines in the diagnostics and nutrition segments.

A significant decrease in demand for its coronavirus rapid tests resulted in a 26.1% plunge in diagnostics revenue to $3.3 billion for the quarter. With baby formula production resuming at its Michigan plant since last summer, demand is just starting to recover. But not before nutrition sales dropped 11.1% over the year-ago period to $1.8 billion during the quarter.

Revenue was relatively flat in the medical devices and established-pharmaceuticals segments (the latter of which sells generic medicines in developing countries), which wasn't enough to offset declines in the other two segments.

Adjusted diluted earnings per share (EPS) plummeted 22% year over year to $1.03 in the fourth quarter. Operating expenses dropped more slowly than revenue did, so adjusted net margin contracted 270 basis points over the year-ago period to 17.9%.

A 1.6% decrease in Abbott's shares outstanding wasn't enough to offset the hit to profitability, and the bottom line fell faster than the top line during the quarter.

It was an uncharacteristically difficult quarter to close out 2022. But with $2.9 billion invested in research and development for the year and more product launches on the way, the future still looks bright. That's why analysts anticipate that Abbott will increase adjusted diluted EPS by 8.3% annually through the next five years.

A dividend with robust growth potential

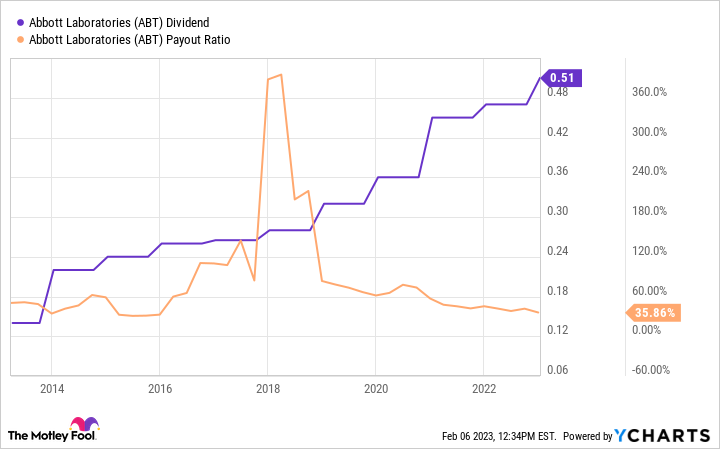

Abbott's 1.8% dividend yield is moderately higher than the S&P 500 index's 1.6%. But payout increases in the medium term should be right around the most-recent hike of 8.5% declared last December.

The company's dividend payout ratio is expected to be about 46% in 2023, balancing shareholder rewards with the capital necessary to drive profits steadily higher.

Should you buy Abbott right now?

In a sense, Abbott has become a victim of the success of its own COVID rapid tests in recent years as retreating demand has weighed on its revenue. But with an innovative culture, the company is almost sure to bounce back.

Its trailing-12-month (TTM) dividend yield of 1.8% is in line with the 10-year median yield, making the stock a buy for dividend growth investors at the current $112 price.

Moreover, Abbott's forward price-to-earnings (P/E) ratio of 23.1 is just below the medical devices industry average forward P/E ratio of 24.7. For a Dividend King such as Abbott with solid fundamentals, any discount to peers is worth buying in my opinion.

But if you're looking for even higher yield, we advocate for companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, our friends at Banyan Hill have identified the top dividend stock for the remainder of 2022…

A stock they're convinced is your best chance to fight back against rising inflation and a looming recession.

With a massive 14% yield, this stock has been so consistent with its payouts they call it a “Sure Thing.”

And they're ready to share it with you today.

They'll also send you 4 additional inflation busting dividend stocks with the potential to increase your income every year without investing a single penny more!

It's all in their Income Forever Bundle.

But this is a limited time offer, so click here to claim your FREE Income Forever Bundle today.

Originally published on Fool.com

Kody Kester has positions in Abbott Laboratories. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool has a disclosure policy.