Financial markets are what are known as “discounting mechanisms.”

But that doesn’t mean what most people think it means.

Most of us hear the word “discount” and think we're getting something on sale.

But that’s not what this kind of discounting is.

In financial markets, discounting means determining the present value of a stream of payments (or an asset).

And in order to determine the present value of a stream of payments (or an asset), one must have reliable information about the payments or asset in question.

That’s why you hear people saying that the stock market hates uncertainty.

And that’s because you can’t discount uncertainty.

Yet that’s exactly what we’re all getting in the stock market these days.

So instead of trying to tell you what’s going to happen next, I’m going to give you some advice that will pay off in droves no matter what happens next…

That advice is as follows…

Everyone NEEDS Dividends

Simple advice. But it requires some explanation to really drive home how important it is…

Dividends are a portion of a company’s profits that it chooses to share with investors.

When you buy a share of stock in a company, you become a part-owner of that company and you may be entitled to receive some of the profits the company earns.

If the company decides to distribute some of its profits to shareholders, it can do so by making a dividend payment.

This means that the company will give a certain amount of money per share to its shareholders, based on how many shares they own.

For example, if a company announces a dividend payment of $0.50 per share and you own 100 shares of that company, you would receive a total of $50 in dividend payments.

And everyone should have dividend-paying stocks in their portfolios.

To some of you, that might not come as a surprise. Dividends mean income and income is a great thing to have in any market.

To others, that might seem crazy. We just got out of a 14-year bull market in everything tech. Why on earth should you want to own anything but a tech stock?

Dividend Investing > All Other Investing

Well, for those of you who think I’m crazy, I’ve got news for you: Research shows that dividend stocks outperform all other stocks…

There have been several studies that looked at the historical performance of dividend-paying stocks versus non-dividend-paying stocks.

One study that is often cited is a research paper by professors Eugene Fama and Kenneth French, which analyzed the returns of stocks listed on the NYSE, Amex, and Nasdaq exchanges from 1927–2014.

They found that, on average, stocks that paid dividends had higher returns and lower volatility than non-dividend-paying stocks.

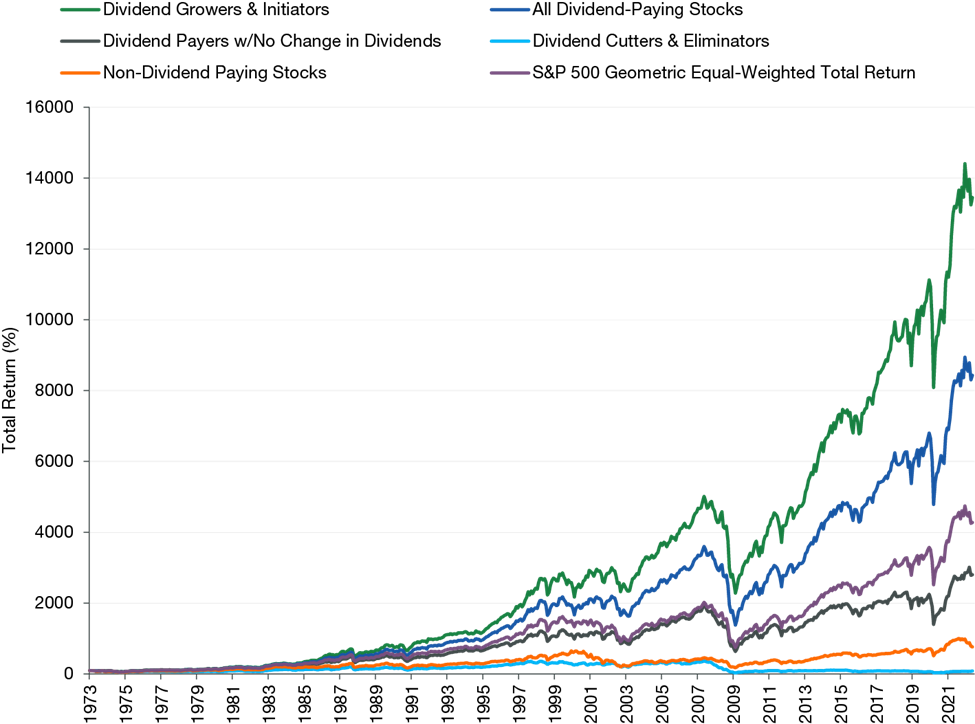

Another study by Ned Davis Research looked at the performance of S&P 500 stocks from 1972–2018.

It found that, over that period, dividend-paying stocks outperformed non-dividend-paying stocks by an average of 2.4% per year.

But there’s actually another class of stocks that outperforms even those dividend payers…

Growing > Paying

That’s dividend growers. You see, companies that steadily grow their dividend outperform all the other categories.

And there are several studies that back up that claim…

One study that looked at this issue is a research paper by investment firm Hartford Funds.

They analyzed the performance of the S&P 500 Dividend Aristocrats index, which includes companies that have consistently increased their dividends for at least 25 years versus the broader S&P 500 index from 1990–2018.

They found that the Dividend Aristocrats index outperformed the S&P 500 index, with an average annual return of 13.6% compared with 9.9%.

Another study by Ned Davis Research looked at the performance of the S&P 500 Dividend Aristocrats index from 1990–2018.

It also found that the dividend-growers outperformed both the S&P 500 index and the S&P 500 High Dividend Yield index, which includes stocks with the highest dividend yields.

So it’s not just the yield that matters, but also the ability to grow that payment over time.

The Eighth Wonder of the World

Now, I realize this all may sound way too simplistic.

But the truth is long-term investing should be simple.

You're using the twin forces of time and dividend growth, and these forces are far more powerful than any analysis, economic forecast, or trading strategy.

There's a reason Albert Einstein once reportedly said, “Compound interest is the eighth wonder of the world. He who understands it earns it… He who doesn't pays it.”

Compounding is the only surefire way to build a fortune in the stock market. And with enough time, it doesn't matter where you start.

And just so you really get the point of how powerful dividends can be (and why high yields aren’t all they’re cracked up to be), let’s do a little math and figure out what kind of difference they can make in your profits…

If you put $5,000 into a $50 stock that pays 8% a year and you hold it 20 years… your investment will be worth $24,377.

That's a 487% gain. Not bad. But it could be a lot better.

That same $5,000 in a stock that pays just 3% — but grows that payment at 20% a year — would be worth $4,055,388 after 20 years. That's a phenomenal 81,327% gain.

It’s why investors like Warren Buffett insist that the companies they invest in spin off cash.

And it’s why everyone NEEDS dividend growers in their investment portfolio.

But not all dividend growers are equal.

Bonus Income Opportunity – The “Ultimate Dividend Package“

Our colleague Marc Lichtenfeld – world-renowned dividend expert and Author of Get Rich With Dividends – is releasing his Ultimate Dividend Package…

Click here to discover:

- His #1 dividend stock…

- The safest 9% dividend in the world…

- And his threetop “Extreme dividend” stocks.

Marc's dividend research is followed by over 500,000 readers.

Like Mort Davidson, who says he's making over $50K a year with dividend stocks.

“I'm making more than $54,000 per year (Yield on cash = 6.84%, gain on cash 14.35%).”

Reader Ed Abernethy likes watching his dividends roll in every month.

“It's very exciting to see money magically appear in my account throughout the month. The knowledge I have gained from Marc has been life changing!”

And Bill Davis says Marc's research helps him provide for his family.

“We have six kids and six grandkids, and we're able to spend more time with them now because we are financially independent.”

Click here to see why they all love dividends!

Originally published on WealthDaily.com