By Money and Markets Staff, Money & Markets, LLC, 2024-10-07

It's time to get on the fast track to stock profits — with the five things you need to make money this week … in just five minutes.

Let's get started!

China's $1.8 Trillion Surprise October Comeback

Over the last month, China's Hang Seng index has surged across the board, gaining a remarkable 30% and becoming the best performer among the 90 global equity gauges tracked by Bloomberg.

In total, investors have poured an estimated $1.8 trillion into Chinese and Hong Kong-based stocks.

That's a sharp contrast to just two years ago when China's stock market was among the world's worst performers. China has struggled in recent years to restore its economy to its pre-pandemic growth levels.

Leadership has also seemed somewhat indifferent to this issue until a recent stimulus package signaled the government's willingness to tackle it head-on.

Some already believe the rally is overblown, but it may also be signaling a renewed surge of interest in Chinese stocks…

The Next Phase of Automation and AI

On Thursday, Tesla TSLA CEO Elon Musk is hosting his company's highly anticipated “We, Robot” event.

Musk is expected to unveil the next stage of his company's ambitious Tesla Robotaxi prototype during the event.

If you want to know why this event could be a significant catalyst for Tesla and other companies involved in this project, our colleague Ian King has you covered.

Click here to learn exactly how to invest as we enter the next phase of the AI and automation boom.

A Wave of Confusion on the Economy

If you're still confused about what the Federal Reserve may do next with interest rates, you aren't alone.

Last week's massive jobs report showed the fastest job growth in six months and dealt a serious blow to the potential of another massive interest rate cut by the end of the year.

The news sent another wave of confusion to investors who were betting heavily on another 50-basis-point cut as early as next month.

It also sent bond rates surging to 4% into Monday morning — a level not seen since August.

With the Fed shifting gears from tackling inflation to preventing a deteriorating jobs market, the latest jobs data has traders preparing for “no landing” rather than a “soft” or “hard” landing in relation to the economy.

A “no landing” scenario occurs when the economy continues to grow, inflation comes back, and the Fed has virtually no room to continue cutting rates.

Now, rather than another 50-basis-point cut, CME's FedTool projects a 25-basis-point cut in November.

As a result, stocks were slow out of the gate this morning. We'll see if that continues throughout the week.

Buffett's Ever-Evolving Fortune

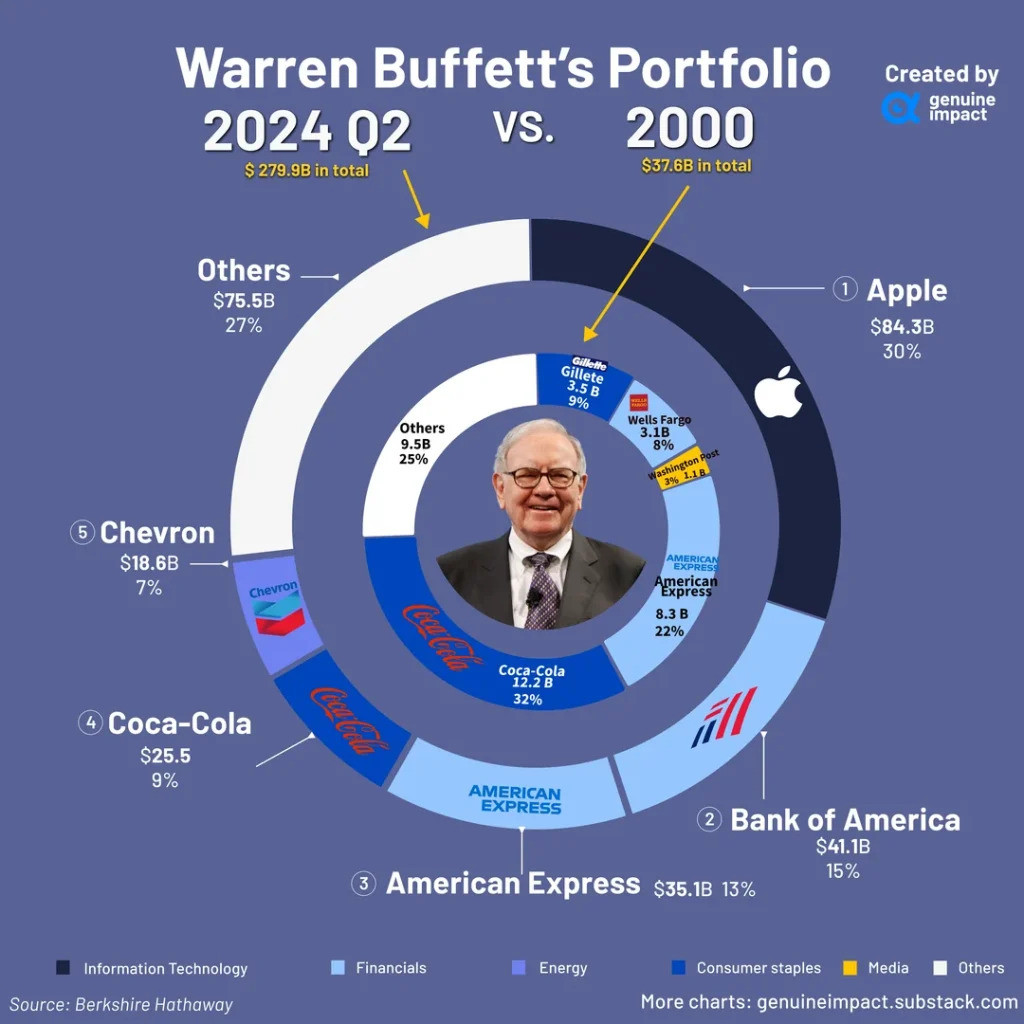

Between 2000 and 2024, Berkshire Hathaway's already-massive investment portfolio grew by nearly 7X in size, from just under $38 billion at the turn of the century to almost $280 billion today.

Just as fascinating as Berkshire's massive size is its ever-changing composition. Over the last year alone, the “Oracle of Omaha” has sold off over $7 billion worth of shares in Bank of America and Apple.

So … what's he keeping? Check out this breakdown from Genuine Impact:

As you can see, Buffett has increased his stakes in big companies like Apple, Bank of America and Chevron while paring down some of his ‘trademark' positions in companies like Gillette and Wells Fargo.

“Berkshire Hathaway's size means that Buffett has little choice but to invest in only the largest companies on the market,” explains Andrew Packer, Managing Editor for the Grey Swan Investing Fraternity. “Buffett famously avoids technology stocks, but Apple fits in as a cash-generating consumer play. His value approach still hasn't changed.”

How Do You Invest?

In this week's Money & Markets Daily poll, we wanted to keep it simple.

There are so many ways to invest these days. You can go with the typical 60/40 stocks and bonds approach, or you can mix in other assets such as options, crypto and gold.

So, how do you invest your hard-earned money?

Vote in our poll now!

Javascript is disabled on your browser. Please enable it in order to use this form.

Your form has been submitted

Thank you %NAME% for taking the quiz/survey/feedback.

We have received your answers. You can view it anytime from this link below:

%TRACK_LINK%

We have also attached a copy of your submission.

Server Side Error

We faced problems while connecting to the server or receiving data from the server. Please wait for a few seconds and try again.

If the problem persists, then check your internet connectivity. If all other sites open fine, then please contact the administrator of this website with the following information.

TextStatus: undefined

HTTP Error: undefined

Error

Some error has occured.

The post China's $1.8 Trillion Surprise October Comeback appeared first on Money & Markets, LLC.