25X Predicted For THIS Crypto – Starting on June 24th (just partnered with Amazon)

Sponsored

This tiny 20-cent crypto just partnered with one of the biggest companies in the world… Amazon. And one team of crypto experts has identified it as the most promising crypto of 2024. You can see all of the details surrounding the #1 Crypto of 2024 here: >20-Cent Amazon Coin<

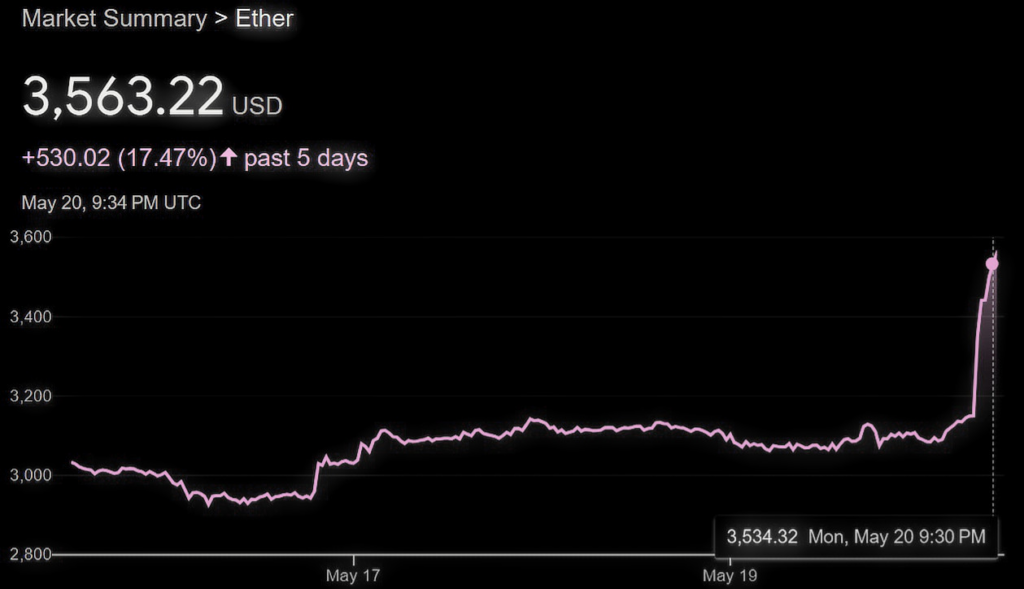

The likelihood of the SEC approving spot Ethereum ETFs has recently surged from 25% to 75%, according to Bloomberg ETF analysts. This shift signifies a potentially transformative moment for the cryptocurrency market, as several spot Ethereum ETFs are currently awaiting approval. Bloomberg analysts James Seyffart and Eric Balchunas, who initially gave these ETFs a modest 25% chance, have now significantly increased their prediction to 75%.

Changing Sentiment at the SEC

Eric Balchunas revealed in a post on X (formerly Twitter) that inside information suggests a change in the SEC's stance on these ETFs. He and Seyffart are eagerly awaiting updates on the filings to refine their odds further. Eric Balchunas is Senior ETF Analyst for Bloomberg Intelligence where he writes research for the Bloomberg Terminal.

The newfound optimism is causing a stir among those who previously believed the ETFs would be denied, with many now scrambling to reassess their positions. Seyffart added that we can expect a flurry of filings in the coming days, indicating growing momentum behind these applications.

Approval Process and Expectations

For the Ethereum ETFs to receive the green light, the SEC must approve both the 19b-4s (exchange rule changes) and S-1s (registration statements). Once both are approved, it is likely that all ETF applications will be approved simultaneously, allowing the funds to launch. Historically, the approval process for Bitcoin ETFs took considerable time, and a similar timeframe is expected for Ethereum ETFs.

The SEC might approve the 19b-4s first and then take its time reviewing the S-1s, potentially prolonging the approval process. However, despite potential delays, the increasing odds of approval are encouraging for Ethereum enthusiasts. This bullish news has already impacted Ethereum's price, which surged over 11% in the last 24 hours. Should the ETH ETFs receive approval, Ethereum may experience a price surge similar to Bitcoin's when BTC ETFs were approved in January.

Broader Implications for the Cryptocurrency Market

The potential approval of spot Ethereum ETFs is not just significant for Ethereum but also for the broader cryptocurrency market. The introduction of two crypto-based ETFs on the stock market would be a major milestone for crypto innovation and could increase the popularity of cryptocurrencies among traditional investors.

Ethereum vs. Bitcoin: A Comparative Overview

While Ethereum (ETH) and Bitcoin (BTC) are both prominent cryptocurrencies, they serve different purposes and have distinct functionalities:

Purpose

- Bitcoin (BTC): Created in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin was designed as a decentralized digital alternative to traditional currencies, primarily serving as a store of value and medium of exchange.

- Ethereum (ETH): Proposed by Vitalik Buterin in 2013 and launched in 2015, Ethereum is a decentralized platform for building and deploying smart contracts and decentralized applications (dApps). While it has its own cryptocurrency, Ether (ETH), its main focus is to provide a platform for blockchain-based applications.

Technology

- Bitcoin: Uses blockchain technology to maintain a secure and transparent ledger of transactions. Its scripting language is limited, making it less flexible for developers.

- Ethereum: Utilizes a more versatile blockchain that supports Turing-complete programming languages, allowing for the creation of complex smart contracts and dApps. Ethereum's blockchain is designed to be more adaptable and customizable.

Consensus Mechanism

- Bitcoin: Employs Proof of Work (PoW), which involves miners solving complex mathematical problems to validate transactions and create new blocks.

- Ethereum: Initially used PoW but transitioned to Proof of Stake (PoS) with Ethereum 2.0 (the “Beacon Chain” or “Eth2”). PoS is more energy-efficient and involves validators staking their Ether to propose and validate new blocks.

Supply

- Bitcoin: Has a fixed supply of 21 million coins, making it deflationary by design. This scarcity is often compared to precious metals like gold.

- Ethereum: Does not have a hard cap on the total supply of Ether. However, with the implementation of Ethereum Improvement Proposal (EIP) 1559, part of the transaction fees is burned, introducing a deflationary aspect to the system.

Use Cases

- Bitcoin: Primarily used as a digital currency and store of value, often referred to as “digital gold.”

- Ethereum: Besides being a cryptocurrency, it is widely used for creating and managing smart contracts, dApps, and decentralized finance (DeFi) applications. It is the foundation for many initial coin offerings (ICOs) and non-fungible tokens (NFTs).

Looking Ahead

The increasing odds of spot Ethereum ETF approval represent a significant development for the cryptocurrency market. If approved, these ETFs could lead to a substantial rise in Ethereum's value and bring greater innovation and investor interest to the crypto space. As the SEC's decision looms, the market is abuzz with anticipation, and the implications for both Ethereum and the broader crypto ecosystem are profound.

New altcoin could crush Bitcoin + Ethereum combined…

Sponsored

My team of experts and I have just discovered a new coin that we believe EVERY investor needs to pick up right now:

- It's game-changing tech – and may be the most practical application of blockchain to date…

- Some of the biggest names in finance are backing it…

- Much of the top talent in the industry is migrating to this type of project

- And it's priced low right now, which means it's super affordable to get exposure on!

Discover the #1 new altcoin we're recommending all investors get right now!

Now is the time to have your altcoin portfolio on lock.

Since the 2024 Bitcoin halving is now behind us, experts believe prices will continue to rise.

And, during the Bitcoin halving bull run, the coins you get right now at low prices could make you a literal fortune.

Don't miss your chance for life-changing wealth…