8,788% Return Predicted for THIS Crypto (already up 40% in 6 months)

Sponsored

THIS cryptocurrency has gained 40% in 6 months. A crypto millionaire who has researched the space for a decade says it will go up 8,788% in 5 years. The name of this cryptocurrency is revealed right here: >>Name of cryptocurrency<<

By MarketWatch

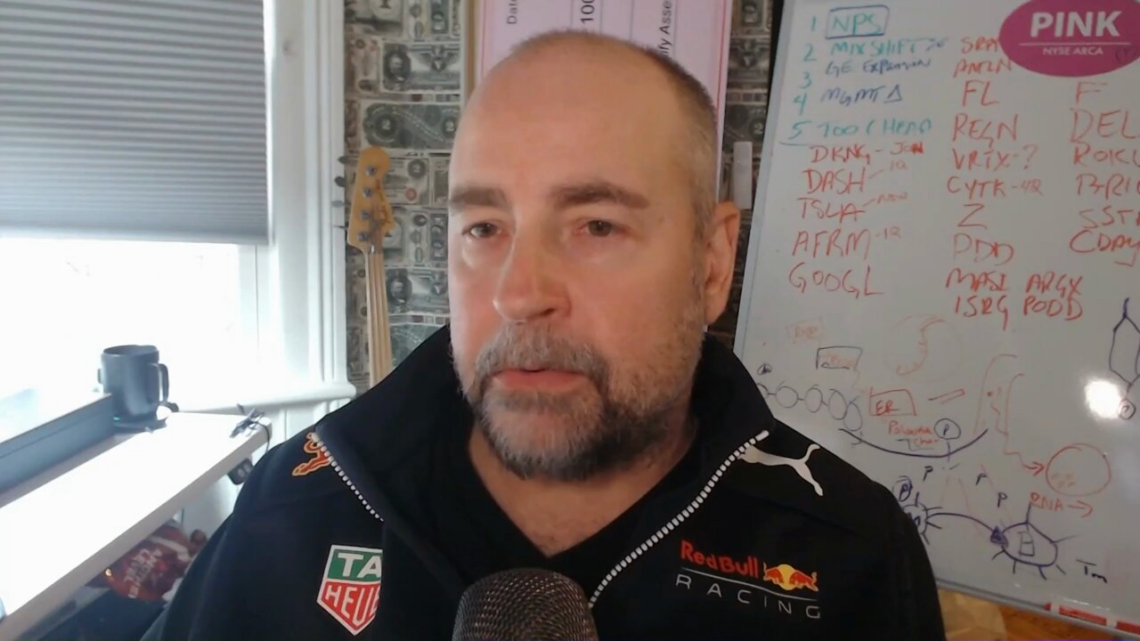

The Simplify Health Care exchange-traded fund has grown to $136 million in assets in two and a half years. It is never easy for an actively managed fund to outperform its benchmark or a broad stock-market index, but Michael Taylor, the fund’s lead manager, has done that so far.

During an interview with MarketWatch, Taylor discussed the fund’s top holdings and also pointed to a stock the fund holds that is outside the healthcare sector and that he thinks has the potential to provide exponential returns.

The Simplify Health Care ETF PINK was launched on Oct. 7, 2021, and the shares began trading the next day. The fund’s annual expenses total 0.50% of assets under management and it donates all of its net profits to Susan G. Komen for the Cure, a nonprofit organization that works to support people with breast cancer and to fund research on prevention and treatment of the disease.

While the fund’s management fees are donated, Taylor said he would profit along with the fund because he is one of its top three shareholders.

PINK has been a good performer since it was established, as you can see below.

Early in his career, Taylor earned a master’s degree in biotechnology at Johns Hopkins University and worked on gene-therapy research projects at GenVac before earning a master’s in business from the University of Rochester and moving into a money-management career, starting at Oppenheimer. He has managed several healthcare-fund portfolios and health-oriented hedge funds over the course of his career.

He described his approach for the Simplify Health Care ETF as “idiosyncratic” — not only for its stock selection but for his ability to move more nimbly than competitors running very large funds in order to right-size investment positions.

Intuitive Surgical

PINK’s largest holding is Intuitive Surgical Inc. ISRG. Taylor believes revenue and profit estimates for this company among analysts working for brokerage firms are too low, because the company plans to bring new robotic-surgery equipment to the market this year. Intuitive trades at valuations of 60.4 times the consensus earnings-per-share estimate for the next 12 months among analysts polled by FactSet, and at a forward price-to-sales ratio of 16.8. These are very high when compared with a forward P/E of 21.1 for the S&P 500 SPX and a forward price/sales ratio of 2.7 for the index.

Then again, Intuitive’s five-year average forward P/E has been 50.8, according to FactSet. Looking ahead at calendar-year estimates, the company is expected to increase its sales at a compound annual growth rate of 13.9% from 2023 through 2025, with an expected EPS CAGR of 12.9%, based on consensus estimates. Those are compared with an expected sales CAGR of 5.3% and EPS CAGR of 12.3% for the S&P 500.

Sarepta Therapeutics

The fund’s second-largest holding is Sarepta Therapeutics Inc. SRPT, which is awaiting Food and Drug Administration approval for its new therapy for Duchenne muscular dystrophy. Taylor believes the stock could double because of the high price tag for the treatment, assuming it is approved. “Sarepta has an opportunity to get a label from the FDA to treat all of DMD, which would turn it into a $5 billion drug for most of the next several years,” he said. The company’s market capitalization is $11.6 billion.

If Sarepta fails to gain FDA approval for its DMD treatment, Taylor expects the stock to drop 30%. But he is confident that his thesis will play out. “And since I treat it as if it is my money, we have a large position,” he said. “Nothing that can destroy us, but enough so we can make serious returns.”

Cigna

The third-largest holding in the PINK portfolio is Cigna Group CI, which is one of six companies in the S&P 500 categorized by FactSet as managed-care providers (or health-maintenance organizations). What sets Cigna apart, according to Taylor, is that nearly all of its business comes from commercial clients — employer-sponsored health-insurance plans — while the other five players are focused on Medicare Advantage plans. Cigna’s shares have returned 44% over the past year.

Cigna’s stock trades at a low forward P/E of 12.4. It is “cheap because the space is overlooked by investors. There is always this looming threat of national healthcare,” Taylor said. He added that competing managers of healthcare funds “got it wrong” in their analysis of the HMO space, because “they didn’t figure out which one would outperform and size for it.”

Eli Lilly

PINK holds shares of Eli Lilly & Co. LLY, which have soared with the success of the company’s GLP-1 medications to treat diabetes and to help people lose weight. But Taylor is steering clear of Lilly’s largest competitor, Novo Nordisk A/S NVO, because the latter’s “prescription trends for dispensing their GLP-1s are not in line with expectations” in the U.S. market. He also said: “I do believe that Lilly has the superior molecule — better safety and better efficacy.”

He sees a long growth runway for GLP-1 medications because they are now covered by Medicare for treatment of diabetes, but are not yet covered for patients who need to lose weight. With so many people at risk for expensive medical problems that can result from obesity, there is potential for a large expansion of this drug category, as Medicare and insurers realize the benefit of covering GLP-1s for more purposes, Taylor said.

A play outside healthcare

In healthcare, especially biotechnology, binary events can make investors a lot of money. A company’s share price may soar as it nears expected FDA approval for a new medicine, treatment or device, and it may crash if it fails to gain approval.

The Simplify Health Care ETF can have up to 20% of its portfolio invested outside the healthcare sector, and Taylor cited PureCycle Technologies Inc. PCT as an example of such a stock. And it sure is a binary play. The company has a market capitalization of less than $1 billion. It has licensed technology from Procter & Gamble Co. PG that enables recycling of polypropylene.

Polypropylene is a commonly used plastic that people often put into recycling bins. Even though it is sorted by waste-management companies, this type of plastic isn’t being recycled. PureCycle expects its facility in Ironton, Ohio, which was built in 2023, to become fully operational this year.

“[PureCycle] is on the cusp of going massively global, with three plants in Asia, one in Europe and two in the U.S.” planned, Taylor said. He also said that demand for PureCycle’s services was “off the chart” and that the Ironton plant had a “20-year backlog” of business.

He said it remained to be seen if [PureCycle’s] recycling of polypropylene into pellets for industrial use would eventually result in profit margins superior to those of manufacturers making new plastic from petroleum. But he also called PureCycle “a solo pure-play with an [intellectual property] moat.”

“[PureCycle] is in PINK because I expect this to be a 50-bagger over the next decade. There is nothing else like it,” Taylor said. By “50-bagger,” he meant a potential gain of 50 times for the shares.

Where to invest $50 right now…

Sponsored

Before you consider trading any of the stocks in our reports, you'll want to see this. Investing Legend Ross Givens just revealed his #1 stock for 2024. And it's not in any of our reports… After managing hedge funds for one of the world's largest banks, he's decided to go “all-in” on the one stock that could make investors rich in 2024. You can view it on Mr. Givens's website, here. Wondering what stock I'm talking about? Click here to watch his presentation and learn for yourself. But you have to act now because a catalyst coming in a few weeks is set to take this stock mainstream… And by then, it could be too late. Click here to reveal Ross Givens's #1 stock for 2024…