DRIP stands for Dividend Reinvestment Plan. When an investor is enrolled in DRIP stocks, it means that incoming dividend payments are used to purchase more shares of the issuing company – automatically.

Many businesses offer DRIPs that require the investors to pay fees. Obviously, paying fees is a negative for investors. As a general rule, investors are better off avoiding DRIP stocks that charge fees.

Fortunately, many companies offer no-fee DRIP stocks. These allow investors to use their hard-earned dividends to build even larger positions in their favorite high-quality, dividend-paying companies – for free.

Dividend Aristocrats are the perfect form of DRIP stocks. Dividend Aristocrats are elite companies that satisfy the following:

- Are in the S&P 500 Index

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

Think about the powerful combination of DRIPs and Dividend Aristocrats…

You are reinvesting dividends into a company that pays higher dividends every year. This means that every year you get more shares – and each share is paying you more dividend income than the previous year.

This makes a powerful (and cost-effective) compounding machine.

This article takes a look at the top 5 Dividend Aristocrats that are no-fee DRIP stocks, ranked in order of expected total returns from lowest to highest.

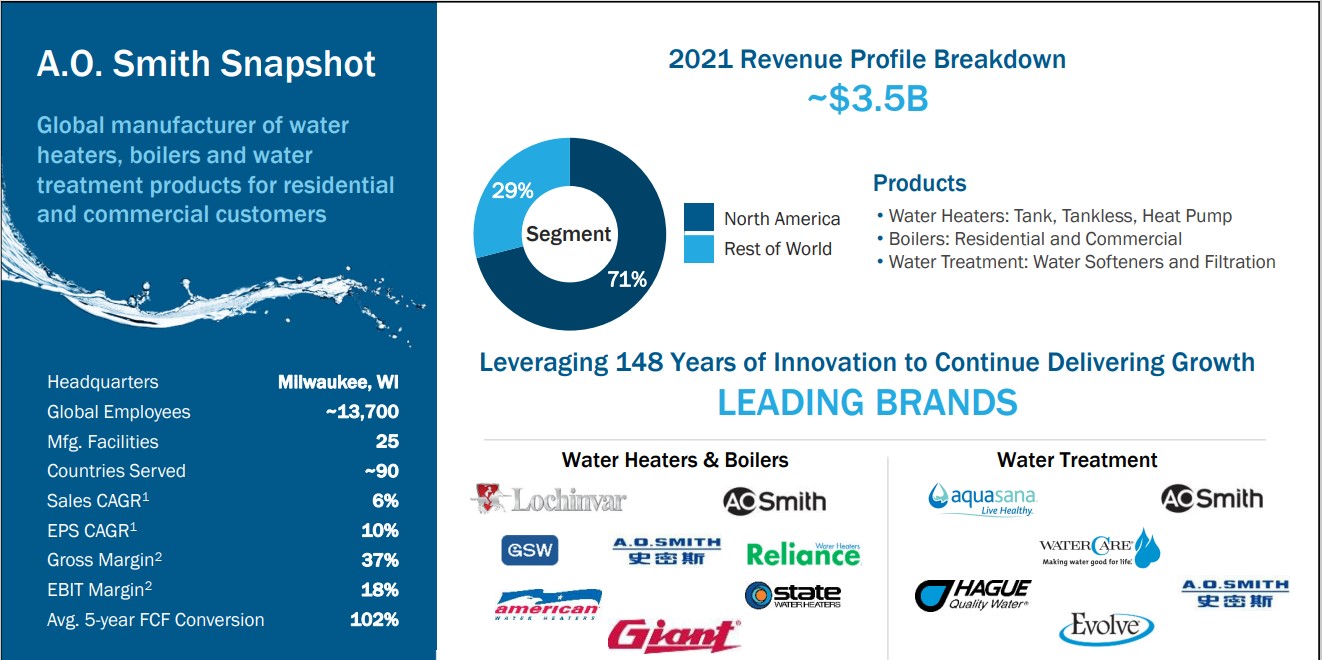

No-Fee DRIP Dividend Aristocrat #5: A.O. Smith (AOS)

- 5-year expected annual returns: 7.5%

A.O. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment products. A.O. Smith generates the majority of its sales in North America, with the remainder from the rest of the world.It has category-leading brands across its various geographic markets.

A.O. Smith is one of the top water stocks.

A.O. Smith reported its third quarter earnings results on October 27. The company generated revenues of $870 million during the quarter, which represents a decline of 4% compared to the prior year’s quarter. Revenues were flat in North America and declined by 13% in the rest of the world, due to currency rate movements and COVID-related shutdowns in China as well.

A.O. Smith generated earnings-per-share of $0.69 during the third quarter, which was down 15% on a year over year basis. This can mostly be explained by the combination of lower revenues and some margin headwinds from inflation and negative operating leverage. A.O. Smith has reaffirmed its guidance for 2022.

The company is forecasting earnings-per-share in a range of $3.05 and $3.15. At the midpoint of the guidance range, A.O. Smith’s earnings-per-share would grow by 3% for 2022.

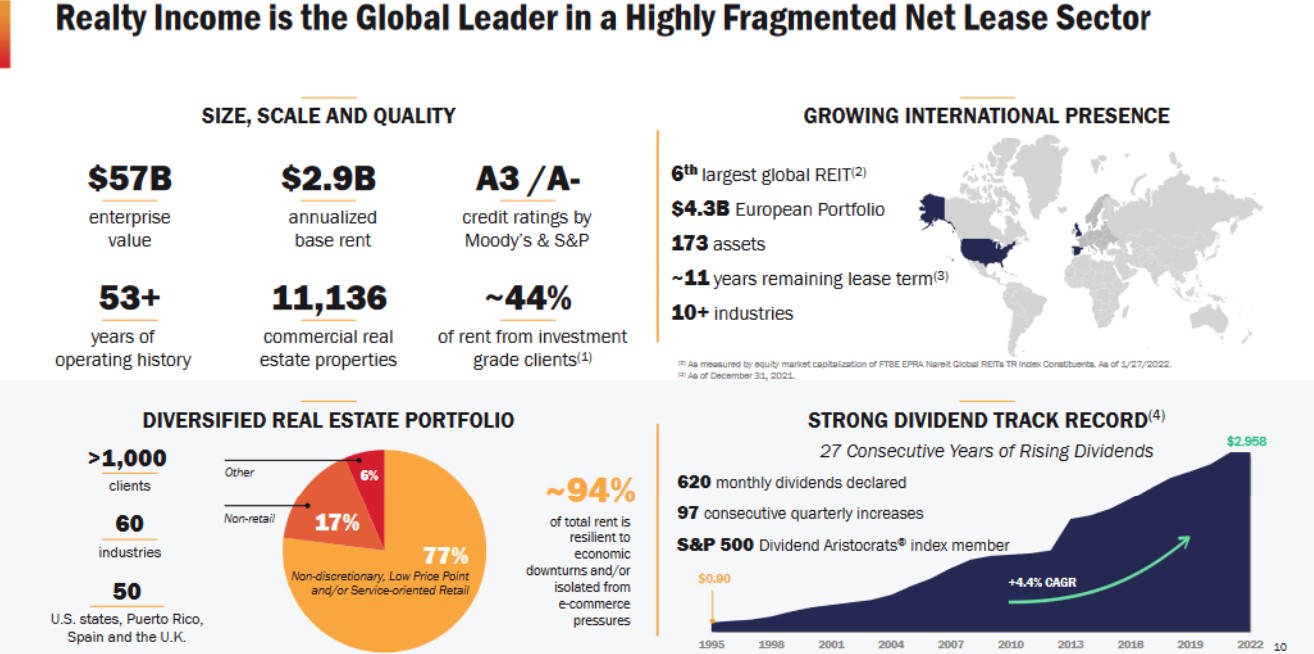

No-Fee DRIP Dividend Aristocrat #4: Realty Income (O)

- 5-year expected annual returns: 8.7%

Realty Income is a retail-focused REIT that owns more than 6,500 properties. It owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

The company’s long history of dividend payments and increases is due to its high-quality business model and diversified property portfolio.

Realty Income announced its third quarter earnings results on November 3. The trust reported that it generated revenues of $840 million during the quarter, which was 71% more than the revenues that Realty Income generated during the previous year’s quarter.

Realty investments into new properties and its acquisition of VEREIT that closed in late 2021 impacted the year-over-year comparison to a large degree. Realty Income’s funds-from-operations rose substantially versus the prior year’s quarter, although AFFO-per-share growth was lower, due to share issuance.

Realty Income nevertheless managed to generate adjusted FFO-per-share of $0.98 during the quarter. Realty Income expects that its results during 2022 will represent a new record, as funds from operations are forecasted to come in at ~$3.90 on a per-share basis during fiscal 2022.

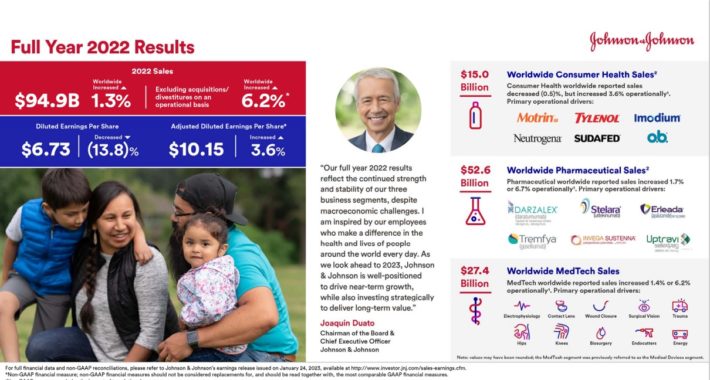

No-Fee DRIP Dividend Aristocrat #3: Johnson & Johnson (JNJ)

- 5-year expected annual returns: 8.7%

Johnson & Johnson is a diversified health care company and a leader in the area of pharmaceuticals (~49% of sales), medical devices (~34% of sales) and consumer products (~17% of sales). The company has annual sales in excess of $93 billion.

The company’s most recent earnings report was delivered on January 24th, 2023 for the fourth quarter and full year. For the fourth quarter, adjusted EPS of $2.35 beat by $0.11, while revenue of $23.7 billion missed slightly.

Full-year results can be seen in the image below:

For 2023, the company expects 4% adjusted operational sales growth (excluding the COVID-19 vaccine) and 3.5% adjusted earnings-per-share growth.

Johnson & Johnson’s key competitive advantage is the size and scale of its business. The company is a worldwide leader in several healthcare categories. Johnson & Johnson’s diversification allows it to continue to grow even if one of the segments is underperforming.

The company has increased its dividend for 60 consecutive years, making it a Dividend King. The stock is owned by many well-known money managers. For example, J&J is a Kevin O’Leary dividend stock.

No-Fee DRIP Dividend Aristocrat #2: 3M Company (MMM)

- 5-year expected annual returns: 15.7%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries.3M is now composed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management software as well as manufactures personal protective gear and security products.

The Healthcare segment supplies medical and surgical products as well as drug delivery systems. Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs. The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies.

3M announced fourth-quarter and full-year earnings results on January 24th:

Fourth-quarter organic revenue increased 0.4%, while total revenue declined 5.9% to $8.1 billion due to the strong U.S. dollar. Adjusted EPS of $2.28 missed estimates by $0.11.

The company also announced that it will be spinning off its Health Care segment into a standalone entity, which would have had $8.6 billion of revenue in 2021.

The transaction is expected to close by the end of 2023.

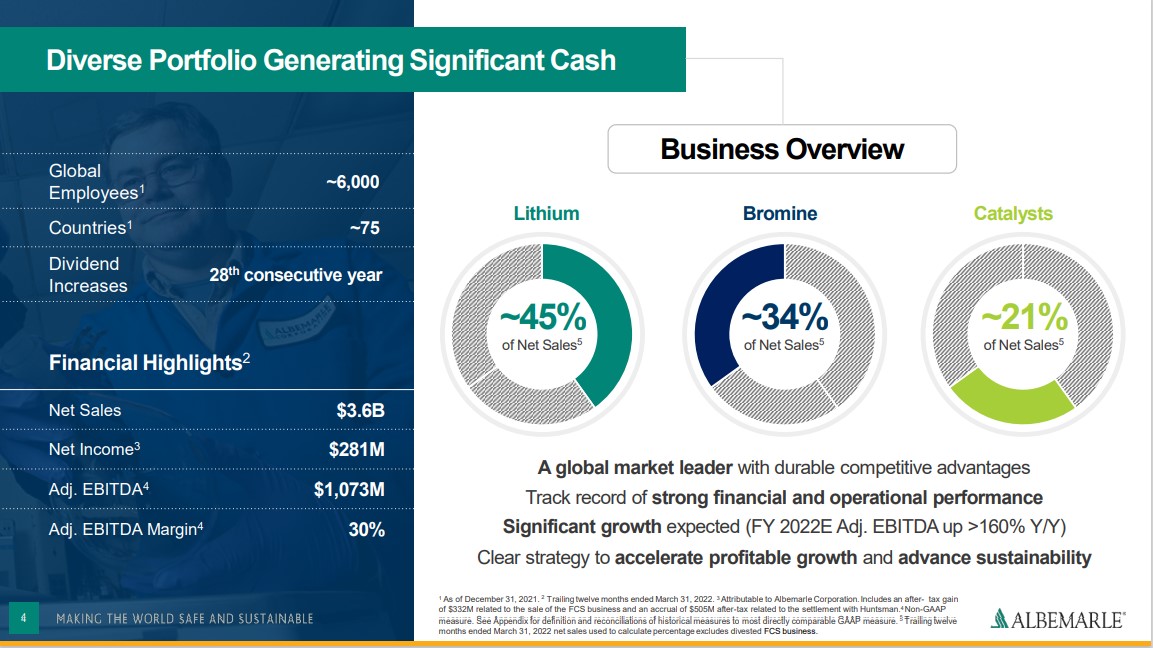

No-Fee DRIP Dividend Aristocrat #1: Albemarle Corporation (ALB)

- 5-year expected annual returns: 17.0%

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile. The company has two joint ventures in Australia that also produce lithium.

Albemarle’s Chile assets offer a very low-cost source of lithium.The company operates in nearly 100 countries and is composed of four segments. Albemarle produces annual sales of more than $5 billion.

The company operates in nearly 100 countries and is composed of four segments: Lithium & Advanced Materials (49% of sales), Bromine Specialties (21% of sales), Catalysts (21% of sales), and Other (9% of sales).

Albemarle produces annual sales of $7.3 billion. It is one of the top lithium stocks.

Final Thoughts and Additional Resources

Enrolling in DRIP stocks can be a great way to compound your portfolio income over time.Additional resources are listed below for investors interested in further research for DRIP stocks.

For dividend growth investors interested in DRIP stocks, the 5 companies mentioned in this article are a great place to start. Each business is very shareholder friendly, as evidenced by their long dividend histories and their willingness to offer investors no-fee DRIP stocks.

We often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, our friends at Banyan Hill have identified the top dividend stock for the remainder of 2022…

A stock they're convinced is your best chance to fight back against rising inflation and a looming recession.

With a massive 14% yield, this stock has been so consistent with its payouts they call it a “Sure Thing.”

And they're ready to share it with you today … absolutely FREE.

What's more, they'll send you 4 additional inflation busting dividend stocks with the potential to increase your income every year without investing a single penny more!

It's all in their FREE package called the Income Forever Bundle.

But this is a limited time offer, so click here to claim your FREE Income Forever Bundle today.

Originally published on SureDividend.com