Elon Musk: THIS will be bigger than Tesla

Sponsored

Hello. I'm James Altucher. I've been called a “genius investor” by my fans… And an “eccentric millionaire” by some others. I think it's because I make big predictions… That tend to come true. Today, I'm revealing a brand-new prediction:

American manufacturing will leave China…

And make a triumphant return to America…

Thanks to AI-powered robots.

The technology is being developed right now. I'm talking about, among others… Elon Musk's Optimus robots. These robots are autonomous workers… Embedded with a smart “AI brain”. Musk is going to use thousands of them in Tesla factories… AI robots will make it cheaper to manufacture goods here in America than China. And they'll create new American jobs in construction, maintenance, transportation, management, and more. Musk believes the potential of these robots is almost limitless… And could soon exceed Tesla's revenues… He's even said his robots have the potential to be used in homes… To make dinner and do housework… Care for the elderly… Or even hinted at them… Being a buddy or “romantic companion” for lonely people. Now that may sound strange… (And perhaps it is.) But I've learned not to bet against Musk's vision. And this is just one of the ways AI will transform our economy and society.In fact, I now predict… Between now and January 9, 2024… Next generation AI technology will open a “wealth window”… That could be the biggest wealth-building opportunity of your lifetime. I now expect AI to be the first $100 TRILLION industry. There could be trillions available to those who get in early… Today, for the first time… I'm showing good Americans exactly what to do… Go here now to see my plan… For investing in AI during this brief “wealth window”.

P.S. If you missed out on crypto, this could be your second chance. The AI “wealth window” is opening now, but you must get in before January 9, 2024. Don't delay. See all the details you need here.

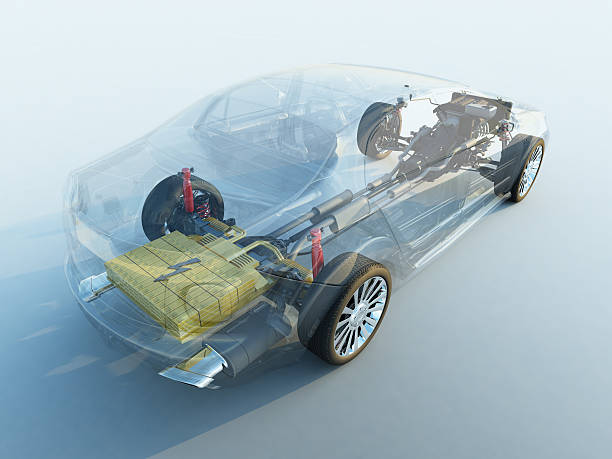

Investing in lithium penny stocks can be both enticing and risky. Penny stocks are typically characterized by low share prices, often trading for less than $5 per share, and they are often associated with smaller companies that may be in the early stages of development. Lithium, a crucial component in rechargeable batteries for electric vehicles and various electronic devices, has garnered significant attention due to the growing demand for clean energy solutions.

The electric vehicle (EV) revolution continues to grow, and with it, a surge in demand for the “white gold” of the battery age: lithium. This has sent shockwaves through the mining and exploration sectors, particularly for lithium penny stocks – small, publicly traded companies with share prices below $5.

Investing in lithium penny stocks is akin to riding a wild mustang. The potential for explosive returns is undeniable, propelled by the insatiable appetite of EV manufacturers. But like any wild ride, it’s equally fraught with peril – volatile markets, unproven technologies, and the ever-present risk of exploration failure.

So, before you saddle up and dive headfirst into the lithium penny stock rodeo, let’s take a deep breath and assess the landscape.

Here’s a detailed exploration of lithium penny stocks:

Lithium Market Overview

Lithium is a key element in the production of rechargeable batteries, and its demand has surged with the rise of electric vehicles (EVs) and renewable energy storage. Lithium-ion batteries are widely used in EVs, smartphones, laptops, and other portable devices.

Why Invest in Lithium Penny Stocks

Growth Potential: The increasing demand for lithium in the EV and renewable energy sectors suggests potential growth for companies involved in lithium exploration, mining, and processing.

Market Trends: The global push towards clean energy and the electrification of transportation has led to a surge in lithium demand, making lithium-related stocks attractive to investors.

What Exactly Is Lithium?

Lithium is a chemical element with the symbol Li and atomic number 3. It is a soft, silvery-white alkali metal, and it is the lightest metal and lightest solid element under standard conditions. Here are some key points about lithium:

Chemical Properties

Lithium belongs to the alkali metal group in the periodic table, along with elements like sodium, potassium, and rubidium. It has a single electron in its outer shell, making it highly reactive.

Occurrence

Lithium is a relatively rare element in the Earth’s crust, but it can be found in various minerals. The main sources of lithium include spodumene, lepidolite, petalite, and lithium-containing brine deposits.

Extraction

Lithium is typically extracted from these minerals through various processes, including mining, chemical extraction, and evaporation of lithium-containing brines.

Applications

Lithium has diverse applications, but one of its primary uses is in the manufacturing of rechargeable lithium-ion batteries. These batteries are widely used in electronic devices like smartphones, laptops, and digital cameras, as well as in electric vehicles (EVs) and renewable energy storage systems.

Medical Uses

Lithium compounds are also used in medicine, particularly lithium carbonate, which is prescribed for the treatment of bipolar disorder.

Nuclear Physics

Lithium is used in certain types of nuclear reactors as a component of lithium-6 deuteride. It serves as a neutron moderator and helps control nuclear reactions.

Lightweight and Reactive

Lithium is known for its low density and high reactivity. It can react violently with water and air, so it is often stored in oil to prevent oxidation.

Global Demand

The demand for lithium has significantly increased in recent years due to the growing popularity of lithium-ion batteries, driven by the rise of electric vehicles and the increasing use of renewable energy sources.

Given its crucial role in modern battery technology, lithium plays a pivotal role in the transition towards cleaner and more sustainable energy solutions. As technology continues to advance, the demand for lithium is likely to remain high, making it an essential element in the context of the evolving energy landscape.

Risks Associated with Lithium Penny Stocks

Volatility: Penny stocks are known for their price volatility. Rapid price fluctuations can be triggered by various factors, including market sentiment, company news, or broader economic conditions.

Company Viability: Many penny stocks represent smaller, early-stage companies that may face financial challenges. It’s crucial to carefully assess the financial health, management team, and business strategy of any company before investing.

Market Conditions: Lithium prices are influenced by market conditions, geopolitical factors, and global economic trends. A drop in lithium prices could impact the profitability of lithium-related companies.

3 Lithium Penny Stocks – Pros and Cons

Lithium Americas (LAC)

Pros: Diversified portfolio with projects in North and South America, including the massive Thacker Pass project in Nevada. Partnerships with major automakers like Ford and Stellantis. Already in the construction phase at Thacker Pass.

Cons: Complex management due to multiple projects across continents. Stock price highly volatile and susceptible to news and market sentiment. Exposed to political and economic instability in South America.

American Lithium (AMLI)

Pros: Pure exploration play focused solely on Thacker Pass, potentially reducing risk compared to geographically diverse companies. Early drilling results showed promise for lithium presence.

Cons: High exploration risk, with no guarantee of commercially viable lithium deposits. Limited funding and revenue, requiring additional capital raises in a volatile market. Low trading volume and limited analyst coverage making it illiquid and information scarce.

Xplore Resources (XPON)

Pros: Geographic diversification with projects in Argentina, Chile, and Bolivia. Generating some revenue from the Salar de Pocitos project. Betting on potentially disruptive Direct Lithium Extraction (DLE) technology if successful.

Cons: Most projects in early exploration stages, with a long and uncertain path to production. DLE technology unproven, posing a significant technological risk. Limited information and analyst coverage making due diligence challenging.

Is Now The Time To Buy Lithium Stocks?

The Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production.

The price of lithium has been falling for the past 2 years. This is largely attributed to Asia, where the global adoption rate of EVs (demand) has not met the supply.

And although more EVs are present on the roads than ever before, the market will still take some time to catch up.

Lithium Penny Stocks – Research and Due Diligence

Before investing in any lithium penny stock, thorough research and due diligence are crucial. Consider the following factors:

Financial Health: Examine the company’s financial statements, cash flow, and debt levels to assess its stability and ability to weather market fluctuations.

Management Team: Evaluate the experience and track record of the company’s management team. Competent leadership is essential for navigating the challenges of the industry.

Project Status: Understand the stage of development of the company’s lithium projects. Exploration-stage companies may be riskier but could offer higher returns if they successfully develop viable lithium assets.

Regulatory Environment: Be aware of the regulatory landscape for lithium mining and processing in the regions where the company operates. Regulatory challenges can impact project timelines and costs.

Lithium Penny Stocks – Conclusion

Investing in lithium penny stocks can be a speculative venture with the potential for substantial rewards but also significant risks. It’s crucial for investors to approach such investments with caution, conduct thorough research, and diversify their portfolios to mitigate risks. Furthermore, staying informed about developments in the lithium market and the broader renewable energy sector is key to making informed investment decisions.

However, if you have a high-risk tolerance, a thirst for adventure, and a deep belief in the EV revolution, then lithium penny stocks might be the wild mustang you’ve been waiting to ride. Just make sure you have a firm grip on the reins and a safety net below.

Tiny $3 AI Stock Primed to Skyrocket

Sponsored

During his time as a Vice President for a major Wall Street bank… Ross Givens exploited his privileged position to help make his clients filthy rich. That was his job. Today, he's re-deploying this knowledge to help the ordinary Joe unlock the most explosive moneymaking opportunity in America. It centers on an extraordinary “$3 AI Wonder Stock”… This single stock gives you the opportunity to “lock in” the retirement of your dreams… Who knows? Perhaps even set you up for millionaire status. It will blow your mind. You can get the full details here in his new video.

But hurry… Things are moving super-fast. The longer you wait, the more returns you could be giving up… Go here ASAP to find out more about this “$3 AI Wonder Stock”.