With the swift stock market decline we’ve seen since the start of 2022, you can be forgiven if your stomach tightens just a bit when you go to check your retirement account.

So today I’m going to give you my three best tips for securing your hard-earned cash — and even better, locking in a dividend stream you can easily live off of in retirement. And no, you won’t need a seven-figure nest egg to pull off what I’m going to show you now.

Step No. 1: Diversify the Right Way

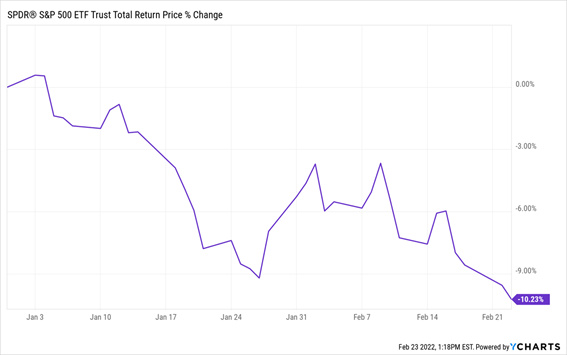

You no doubt know that diversification is key to protecting your wealth, but if you only go halfway, you’re hurting your gain potential (and exposing yourself to potentially severe losses). By “only going halfway,” I mean doing what many folks do: throwing their money in a low-cost index fund like the SPDR S&P 500 ETF Trust (NYSE: SPY) and leaving it at that.

Trouble is, pullbacks don’t affect all stocks equally, and this time around we need to be selective, as still-high stock valuations and overwrought fears over rising rates mean some sectors have taken bigger hits than others. And in today’s cruel market, sometimes individual stocks report spotless quarterly earnings and still get punished!

That means we have to take a more active approach, because sitting in an index fund locks you into all sectors, and the losers will drag down your overall return, as they’ve done to indexers this year:

“1-Click” Investing Exposes You to Losing Sectors

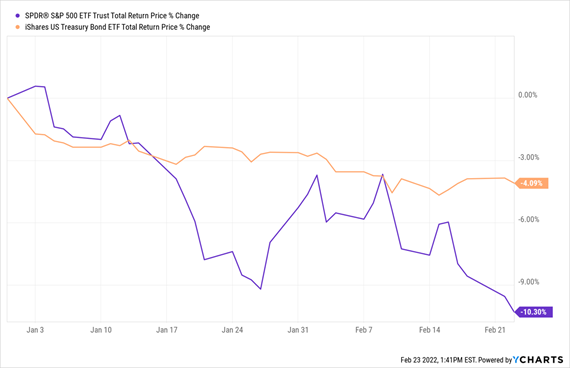

The first step toward protecting our savings? Go beyond stocks to other assets, such as bonds.

Most folks start with government-backed Treasury bonds, which can help offset any hits you might take in the stock market, since Treasurys tend to go up when stocks go down (and vice versa). But that’s not always the case, as we can see below by comparing the performance of the S&P 500 with Treasury bonds using the iShares U.S. Treasury Bond ETF (BATS: GOVT):

The Treasury “Cushion” Goes Flat

And even when Treasurys do move in opposition to stocks in a bear market, they don’t rise enough to offset the drop in stocks. We need to dig deeper.

There are many other investments that go their own way — which isn’t necessarily in the same direction as stocks. For example, municipal bonds tend to rise when people are more risk-averse, while tech stocks fall. So you want to make sure you have a bit of both so you can profit from one when the other goes down.

The municipal bond market can be hard to access for individual investors, which is why I recommend doing so through a closed-end fund (CEF) — more on those below — such as the Nuveen Municipal High Income Opportunities Fund (NYSE: NMZ), a 5.8%-yielder that pays dividends monthly.

This diversification between asset classes is the most important tool the ultra-rich use to protect their nest eggs. The stories you hear of multimillionaires losing everything? It’s almost always a result of failing to diversify. Take Masayoshi Son, the Softbank multibillionaire who lost around $70 billion (yes, with a “b”) during the dot-com crash of 2000. Why? Because all of his money was in stocks.

Step No. 2: Add Some High-Yield Closed-End Funds to Your Stocks

Let’s swing back to stocks for a moment, because buying them through CEFs gives you plenty of advantages here, too. For one, CEFs offer much higher dividend yields than most stocks and ETFs, with payouts greater than 7% the norm in this space.

In addition, due to a quirk in their structure, CEFs often trade at discounts to net asset value (NAV, or the value of their portfolio holdings), while ETFs always trade at par. These discounts are easy to spot on any CEF screener worth its salt, making it easy to tease out bargains.

For example, you could buy a broad-based stock CEF, like the Gabelli Dividend & Income Fund (NYSE: GDV), which holds stocks from across sectors, including Alphabet Inc. (Nasdaq: GOOGL), Mastercard Inc. (NYSE: MA) and JPMorgan Chase & Co. (NYSE: JPM); GDV yields a nice 5.6% as I write this (paid monthly), while trading at a 13% discount to NAV. By going with one stock CEF that covers all sectors, you’re trusting the fund’s manager — in this case superstar value investor Mario Gabelli — to rotate between sectors for you.

The other option is to do it yourself and buy CEFs from different sectors, like the Tekla Life Sciences Investors (NYSE: HQL), and its 9.4% yield, for healthcare; the John Hancock Financial Opportunities Fund (NYSE: BTO) for financial stocks (with a 5.1% dividend); or the Reaves Utility Income Fund (NYSE: UTG) — current yield 7.3% — for utilities. You can then rotate in and out of these funds as their discounts to NAV widen and narrow, or flip from discount to premium.

No matter your strategy, this approach gives you instant diversification across stocks and lowers your risk of overpaying, thanks to your CEFs’ discounts to NAV.

Step No. 3: Lock in Big Cash Dividends

The final key to protecting your nest egg is also the most often overlooked: securing an income stream. Because if you can invest your nest egg in assets that produce income higher than your annual costs, provided that income stream never declines below your expenses, you can largely ignore market swings.

CEFs like the ones we just saw do that, and on a relatively modest upfront investment, too, with their outsized dividends of 5%, 7%, 8% and even more. This is why CEFs are a great basis for the core of your retirement portfolio.

That’s far better than you’ll do with Treasurys: Even with the 10-year Treasury rate reaching 2%, you’re still getting less than $2,000 per month if you invest a million bucks. That’s less than $15 per hour, which is below minimum wage in a large part of the U.S. now.

With the S&P 500, you’re getting even less — $1,085 per month in income on a million dollars. Madness! People try to subsidize these paltry income streams by harvesting capital gains from their stock holdings — but that’s much easier said than done. Structuring payouts in a way that won’t destroy your portfolio is almost impossible, especially if you end up retiring a year or two before a recession.

To demonstrate this, look at what happens to a $1.2 million nest egg put in the S&P 500 just before the 2008-09 meltdown; while it grows a bit before the end of 2008, things go downhill fast:

As if that weren’t bad enough, it’s doubly devastating for retirees who need income from their investments. Look at what happens to a retiree during the same period who tries to live off of $45,000 in passive income on that $1.2 million nest egg:

Even with a conservative 3.8% withdrawal rate, the retiree’s nest egg takes several years to recover from the 2009 loss — and although the S&P 500 recovered by 2013, the retiree’s portfolio would still be down 18.9% from where it was five years earlier.

Why? Because of a lack of a solid income stream. Again, this is why high-yield CEFs, which pay enough to let many folks retire on dividends alone on less than a $500,000 nest egg, are your best plays here.

Originally published on MoneyAndMarkets.com