At Profit Alerts, we make it our daily mission to scour the markets for the most opportunistic high yield investments, whether they are common stocks, preferred stocks, or bonds.

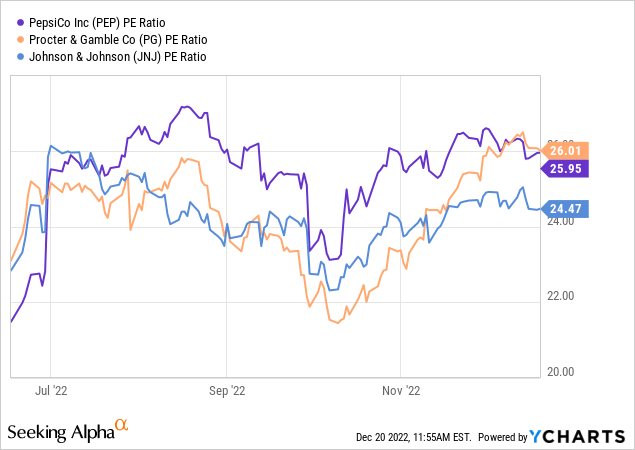

We tend to avoid the most popular and well-known income stocks, because those tend to be overvalued or at least lack an adequate margin of safety. Here are three examples:

Each of these three stocks are admittedly high-quality companies with strong balance sheets and growth prospects as well as impressive track records of dividend growth.

The problem? Everyone knows about them. They are included in dozens of indexes and mutual funds. Their quality is therefore more than reflected in the stock price, leaving little valuation upside.

As you can see above, each of these three stocks trade at P/E ratios in the mid-20s, and each of them offer dividend yields around 2.5%.

For context, if high income is your goal, you could currently buy a 6-month Treasury note backed by the full faith and credit of the US Government for nearly double that yield!

Assuming a dividend growth rate of 7% per year for the three blue-chip dividend stocks listed above, it would take 9.5 years for your yield-on-cost to exceed the ~4.7% yield that you could enjoy with the 6-month Treasury note now – at least for the next half a year.

But even if you'd prefer to lock in your government-backed bond income for 10 years, you could buy a 10-year Treasury bond right now for about a 3.5% yield.

Of course, there is also inflation to think about. Locking in a 3.5% yield, based on an income stream that doesn't grow, for 10 years may very well prove to offer little to no real (inflation adjusted) returns.

That's why we target companies with these three features:

- High yields

- Strong growth prospects

- Margins of safety

Fortunately for us, we are currently in the midst of a “target rich environment” with plenty of opportunistic investments available.

That said, in the midst of this target rich environment, it can be easy to overlook some of the most visible and well-known stocks that have been temporarily discounted to suddenly offer high yields.

As such, it's worth highlighting the following three high-quality and widely known stocks that may be “hiding in plain sight” for the investors hunting for the most opportunistic plays in this market.

Brookfield Infrastructure Partners (BIP)

- Dividend Yield: 4.6%

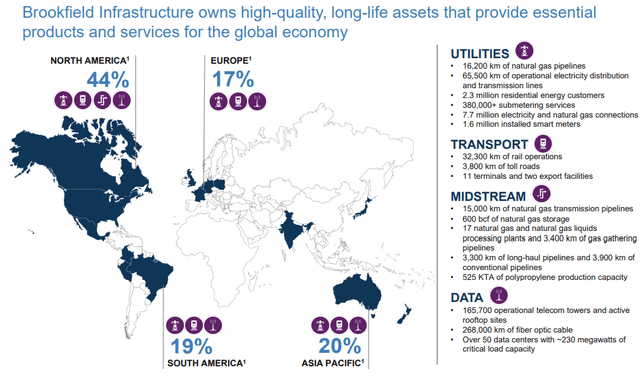

BIP is one of the largest owners of infrastructure assets in the world. Its portfolio of long-lived assets like retail utilities, railroads, natural gas pipelines, and telecommunications towers are spread across the globe.

Considering the trillions of dollars of infrastructure investments that are needed in the coming decades, BIP stands to capture a sizable portion of the growth and contracted cash flows available in this asset class.

The company has identified three megatrends to emphasize in its future investments:

- Digitalization

- Deglobalization

- Decarbonization

An immense amount of data is being created and transmitted every day, which increases the essentiality of its towers, data centers, and fiber lines.

Moreover, as the world undergoes a shakeup in the areas where manufacturing is done, BIP believes its terminals and railroads stand to benefit.

Finally, though BIP is not directly involved in renewable energy, it still believes its portfolio benefits from the decarbonization trend, as natural gas burns much cleaner than the other major fossil fuel of coal.

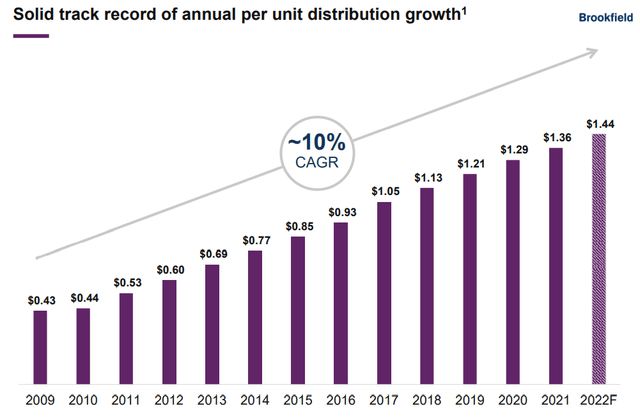

Investments in these spaces should allow BIP to continue its respectable history of dividend/distribution growth:

While management's distribution growth target for BIP is a range of 5-9%, its long-term historical average of ~10% may be possible to keep in place. Especially considering BIP's access to Brookfield Asset Management's (BAM) expertise and its strong cost of capital, illustrated by its BBB+ credit rating.

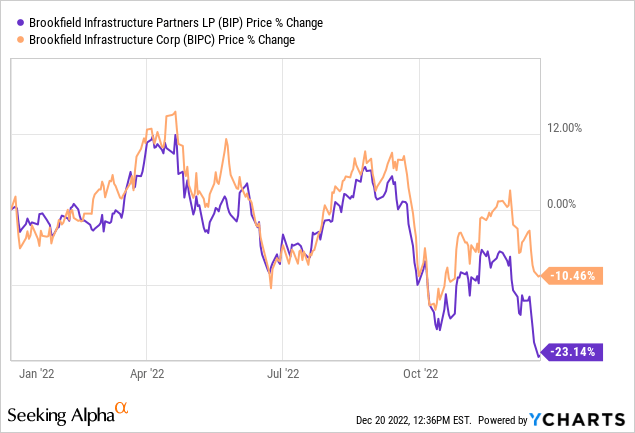

After the recent selloff, BIP now trades at a significant and widening discount to its corporate equivalent, Brookfield Infrastructure Corporation (BIPC).

The downside of choosing BIP over BIPC is that the former generates a K-1 form for tax purposes since its technically a limited partnership. That does create a slight additional complication, but those who use tax accountants or even online tax preparation help can usually handle K-1s fairly quickly and easily.

In any case, BIP looks like an attractive mix of defensive assets, growth, and yield.

Enbridge (ENB)

- Dividend Yield: 6.9%

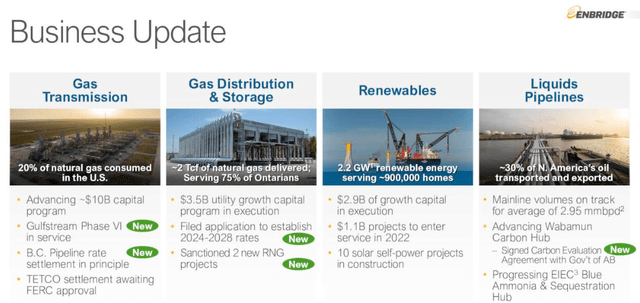

ENB is one of the largest midstream oil & gas companies in North America. Though the company is domiciled in Canada, a large portion of its assets are located across the United States, including several major interstate pipelines.

But in addition to ENB's substantial and growing portfolio of natural gas pipelines and storage facilities, the company is investing heavily into two fast-growing spaces in the world of energy:

- Renewables

- Liquified natural gas exports

After recently acquiring multiple renewable energy developers such as Tri Global Energy, ENB also has an impressive development pipeline of renewable energy assets in North America. The total backlog sits at around 7 gigawatts across North America and Europe, which is nearly 4x larger than its currently operational capacity of 1.8 GW.

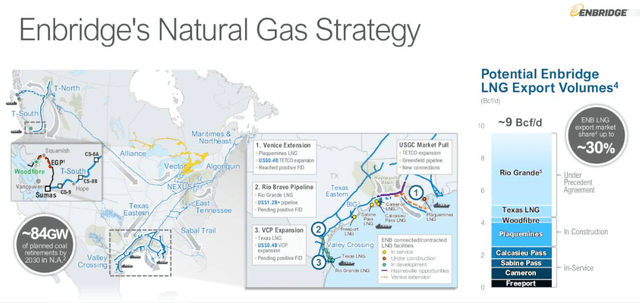

In addition to renewables, ENB is increasing its exposure to the rapidly growing LNG export market in North America that is helping the rest of the world (most notably right now, Europe) meet their energy needs. Through construction of a new export facility and exposure to other export platforms, ENB hopes to increase its share of the North American LNG export market to around 30% by 2040.

ENB also has a strong, investment-grade balance sheet with a BBB+ credit rating and plenty of liquidity. This should ensure that the company has plenty of firepower with which to fund its growth plans in the years ahead.

Verizon (VZ)

- Dividend Yield: 7.1%

On one hand, it's surprising to see the telecommunications industry leader of VZ underperforming so heavily this year. If the definition of a value stock is one that generates lots of cash flow now but lacks substantial potential to grow cash flows into the future, then VZ is the ultimate value stock. And yet, VZ has dramatically underperformed value stocks more broadly this year:

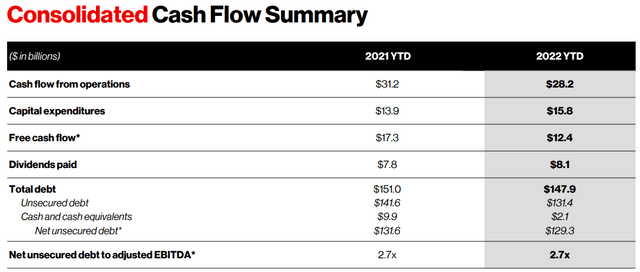

Then again, if you consider that VZ is also one of the most heavily indebted companies in the world on an absolute dollar basis, the underperformance makes sense. After all, this year we have endured one of the fastest spikes in interest rates in recorded history.

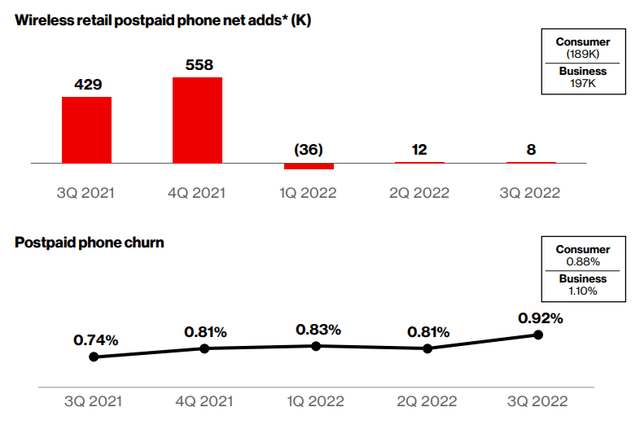

What's more, the core business of selling cell service to mobile phone users has stagnated this year.

While VZ is growing its customer base for broadband, fiber, and fixed wireless services, its core wireless subscriber base has stagnated or slightly declined this year, even as peers have been adding millions of new subscribers with low-cost deals. VZ's churn rate has been higher, even as its capex spending for the 5G rollout has gone up.

But there is good news. CEO Hans Vestberg has made clear that 2022 will be the peak year of capex spending, and this spending should decline next year and beyond. This means that VZ's free cash flow, which dipped in 2022 from the prior year, should rebound nicely in 2023.

This should both expand dividend coverage, making even safer VZ's 7%+ dividend yield, and increase the cash available for debt paydown.

What's more, VZ's early and heavy investments in the 5G rollout should eventually win more customers as the benefits of 5G become more visible and well-known.

Bottom Line

The average yield of these three stocks is 6.2%, and the average 5-year dividend growth rate is 5.3%.

While VZ brings up the average yield for current income, BIP and ENB bring up the average dividend growth rate with their mid- to high-single-digit growth rates.

For retirees and other income-seekers looking for safe high-yielders, there are far worse places to look than these three hidden-in-plain-sight income machines.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Originally published on SeekingAlpha.com