By Austin Hankwitz, Rate of Return by Austin Hankwitz, 2024-08-02

⚡ A Few Observations

To set the stage, here's where we're at…

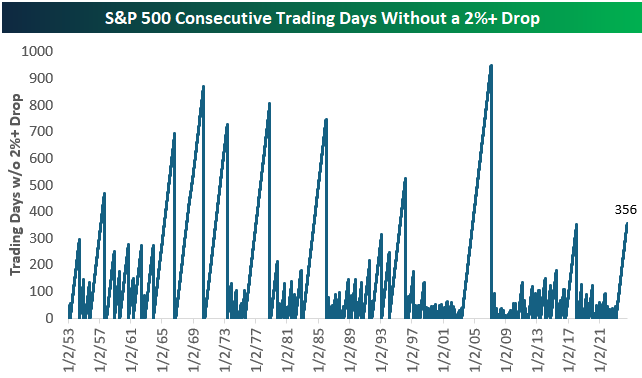

Last week, the S&P 500 Index broke its 356-day streak of low volatility. Specifically, we hadn't experienced a -2% single-day drop in price in nearly an entire calendar year — until last week. As you can see above, after these streaks are finally broken we have trouble starting new streak for several months.

This means volatility should be expected and positioned for.

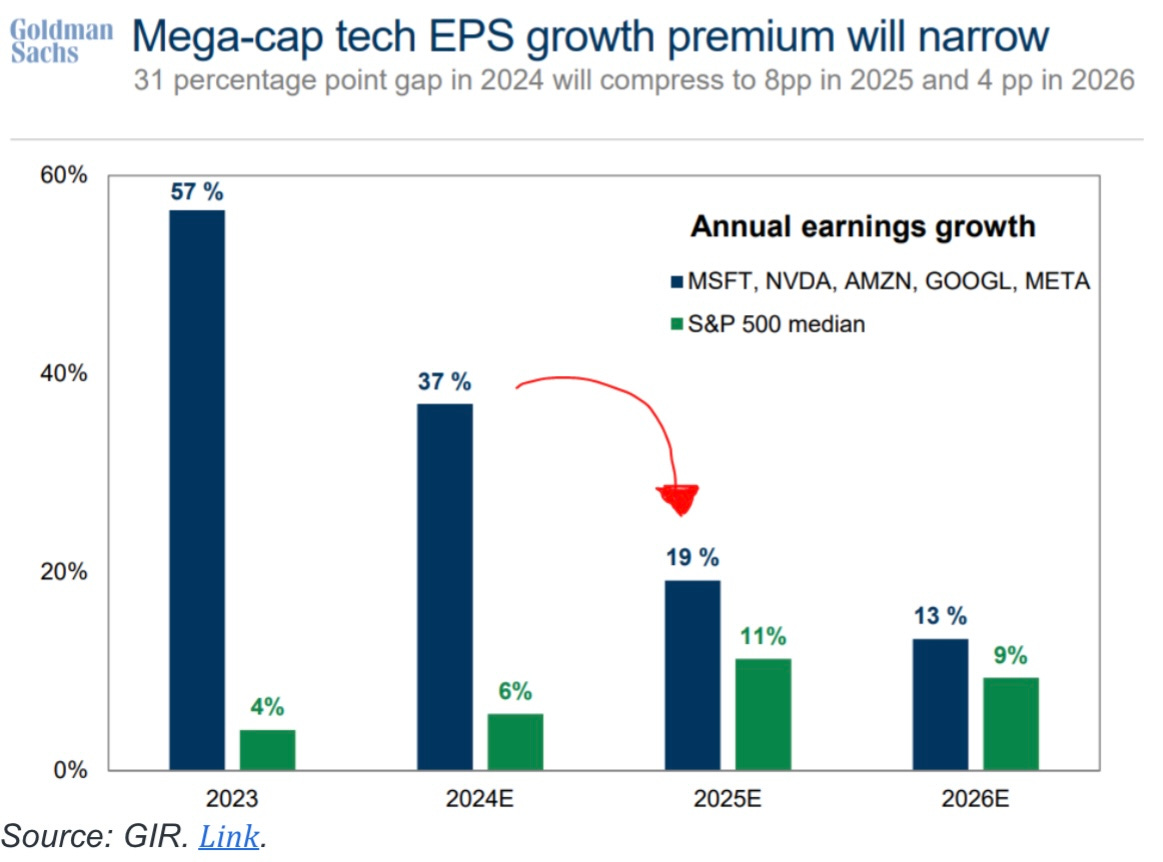

Additionally, it's earnings season — as if there wasn't enough volatility in the markets already! This earnings season we're learning a lot about what these Megacap technology stocks are expecting from an earnings growth perspective for both the rest of the year and calendar year 2025.

As you can see above, Megacap technology stocks (Microsoft, Nvidia, Amazon, Google, and Meta) experienced some insane earnings growth during 2023 (+57%). Wall Street is expecting this earnings growth to slow to +37% in 2024, and decelerate ever further to +19% in 2025.

As if Wall Street had a crystal ball for multiple years into the future (they don't) they're also expecting earnings growth to decelerate even more in 2026 (+13%).

Earnings growth deceleration is not exactly a bullish fundamental characteristic. However, what's more telling is how the median S&P 500 company's earnings growth is trending during the same period of time… up!

2022 was a tough year for the median S&P 500 company — rampant inflation, interest rate hikes, etc. This all caused the median S&P 500 company to report lower-than-expected earnings, forcing the S&P 500 Index to contract by -20% during the 12-month period.

// Get the WordPress post tags and store them in a JavaScript variable

var postTags = ["content"];

// Convert the tags into a comma-separated string

var finalstring = postTags.join(', ');

// Define window.abkw

window.abkw = finalstring;

// Actual AdButler Script

var rnd = window.rnd || Math.floor(Math.random()*10e6);

var pid743502 = window.pid743502 || rnd;

var plc743502 = window.plc743502 || 0;

var abkw = window.abkw || '';

var absrc = 'https://servedbyadbutler.com/adserve/;ID=173641;size=0x0;setID=743502;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid743502+';place='+(plc743502++)+';rnd='+rnd+'';

document.write('

// Get the WordPress post tags and store them in a JavaScript variable

var postTags = ["content"];

// Convert the tags into a comma-separated string

var finalstring = postTags.join(', ');

// Define window.abkw

window.abkw = finalstring;

// Actual AdButler Script

var rnd = window.rnd || Math.floor(Math.random()*10e6);

var pid743502 = window.pid743502 || rnd;

var plc743502 = window.plc743502 || 0;

var abkw = window.abkw || '';

var absrc = 'https://servedbyadbutler.com/adserve/;ID=173641;size=0x0;setID=743502;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid743502+';place='+(plc743502++)+';rnd='+rnd+'';

document.write('